海外之声丨全球经济风险犹存,政策重点须转向

导读

IMF更新的全球经济展望指出,全球经济开始进入实现软着陆的最后阶段,通胀稳步下行,增长得到巩固。但经济扩张的步伐仍然缓慢,未来可能会出现动荡。

去年下半年,由于需求和供给因素支撑了主要经济体的增长,全球经济活动呈现出韧性。在需求方面,尽管货币环境紧缩,但私人和政府支出增强,维持了经济活动。在供给方面,尽管地缘政治不确定性再度加剧,但劳动力参与率的提高、供应链的修复以及能源和大宗商品价格的下跌都起了有益的作用。

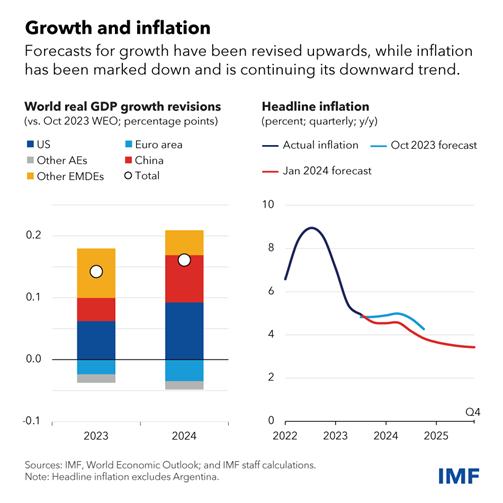

这种韧性将延续下去。根据IMF的基线预测,今年全球经济增速将稳定在3.1%,较去年10月的预测值上调0.2个百分点,明年增速将小幅升至3.2%。

通胀持续下降。除阿根廷外,全球总体通胀今年将降至4.9%,较我们去年10月的预测值(也不包括阿根廷)下降了0.4个百分点。核心通胀(不包括波动较大的食品和能源价格)也呈下降趋势。发达经济体今年的总体和核心通胀平均约为2.6%,接近央行的通胀目标。

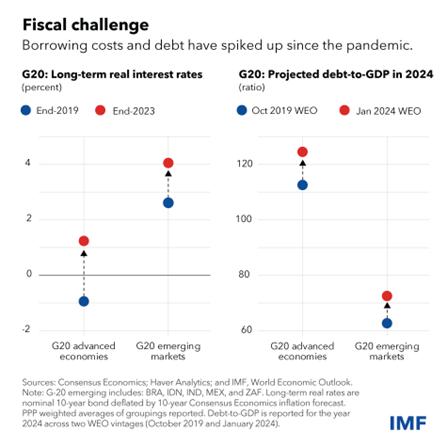

但不确定性依然存在,各国央行现在面临双重风险。我们面临的最大挑战是应对不断上升的财政风险。多数国家在走出疫情和能源危机后都面临更高的公共债务水平和借款成本。降低公共债务和赤字将为应对未来的冲击提供空间。政策重点必须转向修复公共财政和改善中期增长前景。各国需要加快步伐以应对世界面临的诸多结构性挑战:气候转型,可持续发展,以及提高生活水平。

作者丨Pierre-OlivierGourinchas(IMF研究部主任)

GlobalEconomyApproachesSoftLanding,butRisksRemain

Policyfocusmustshifttorepairingpublicfinancesandimprovingmedium-termgrowthprospects

Pierre-OlivierGourinchas

January30,2024

Thecloudsarebeginningtopart.Theglobaleconomybeginsthefinaldescenttowardasoftlanding,withinflationdecliningsteadilyandgrowthholdingup.Butthepaceofexpansionremainsslow,andturbulencemaylieahead.

Globalactivityprovedresilientinthesecondhalfoflastyear,asdemandandsupplyfactorssupportedmajoreconomies.Onthedemandside,strongerprivateandgovernmentspendingsustainedactivity,despitetightmonetaryconditions.Onthesupplyside,increasedlaborforceparticipation,mendedsupplychainsandcheaperenergyandcommoditypriceshelped,despiterenewedgeopoliticaluncertainties.

Thisresiliencewillcarryover. Globalgrowth underourbaselineforecastwillsteadyat3.1percentthisyear,a0.2percentagepointupgradefromour Octoberprojections,beforeedgingupto3.2percentnextyear.

Importantdivergencesremain.WeexpectslowergrowthintheUnitedStates,wheretightmonetarypolicyisstillworkingthroughtheeconomy,andinChina,whereweakerconsumptionandinvestmentcontinuetoweighonactivity.Intheeuroarea,meanwhile,activityisexpectedtoreboundslightlyafterachallenging2023,whenhighenergypricesandtightmonetarypolicyrestricteddemand.Manyothereconomiescontinuetoshowgreatresilience,withgrowthacceleratinginBrazil,India,andSoutheastAsia’smajoreconomies.

Inflationcontinuestoease.ExcludingArgentina,globalheadlineinflationwilldeclineto4.9percentthisyear,down0.4percentagepointfromourOctoberprojection(alsoexcludingArgentina).Coreinflation,excludingvolatilefoodandenergyprices,isalsotrendinglower.Foradvancedeconomies,headlineandcoreinflationwillaveragearound2.6percentthisyear,closetocentralbanks’inflationtargets.

Withtheimprovedoutlook,riskshavemoderatedandarebalanced.Ontheupside:

·Disinflationcouldhappenfasterthananticipated,especiallyiflabormarkettightnesseasesfurtherandshort-terminflationexpectationscontinuetodecline,allowingcentralbankstoeasesooner.

·Fiscalconsolidationmeasuresthatgovernmentshaveannouncedfor2024-25maybedelayedasmanycountriesfacerisingcallsforincreasedpublicspendinginwhatisthebiggestglobalelectionyearinhistory.Thiscouldboosteconomicactivity,butalsospurinflationandincreasetheprospectofdisruptionlater.

·Lookingfurtherahead,rapidimprovementinArtificialIntelligencecouldboostinvestmentandspurrapidproductivitygrowth,albeitonewith significantchallengesforworkers.

Onthedownside:

·Newcommodityandsupplydisruptionscouldoccur,followingrenewedgeopoliticaltensions,especiallyintheMiddleEast.ShippingcostsbetweenAsiaandEuropehaveincreasedmarkedly,asRedSeaattacksreroutecargoesaroundAfrica.Whiledisruptionsremainlimitedsofar,thesituationremainsvolatile.

·Coreinflationcouldprovemorepersistent.Thepriceofgoodsremainshistoricallyelevatedrelativetothatofservices.Theadjustmentcouldtaketheformofmorepersistentservices—andoverall—inflation.Wagedevelopments,particularlyintheeuroarea,wherenegotiatedwagesarestillontherise,couldaddtopricepressures.

·Marketsappearexcessivelyoptimisticaboutthe prospects forearlyratecuts.Shouldinvestorsre-assesstheirview,long-terminterestrateswouldincrease,puttingrenewedpressureongovernmentstoimplementmorerapidfiscalconsolidationthatcouldweighoneconomicgrowth.

Policychallenges

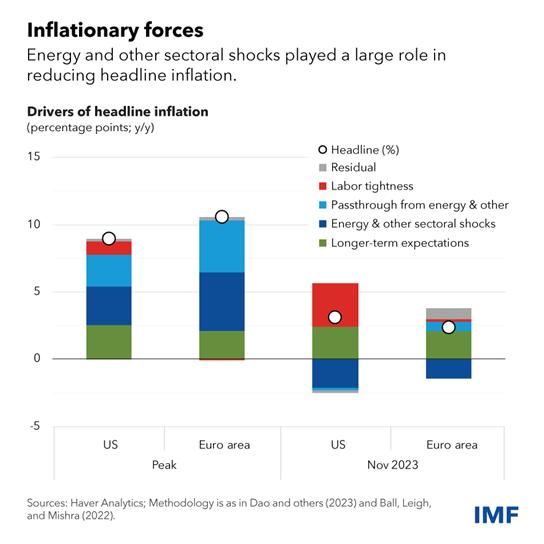

Withinflationrecedingandgrowthremainingsteady, itisnowtimetotakestockandlookahead. Ouranalysis showsthatasubstantialshareofrecentdisinflationoccurredviaadeclineincommodityandenergyprices,ratherthanthroughacontractionofeconomicactivity.

Sincemonetarytighteningtypicallyworksby depressingeconomicactivity,arelevantquestioniswhatrole,ifany,hasmonetarypolicyplayed?Theansweristhatitworkedthroughtwoadditionalchannels.First,therapidpaceoftighteninghelpedconvincepeopleandcompaniesthathighinflationwouldnotbeallowedtotakehold.Thispreventedinflationexpectationsfrompersistentlyrising,helpeddampenwagegrowth,andreducedtheriskofawage-pricespiral.Second,theunusuallysynchronizednatureofthetighteningloweredworldenergydemand,directlyreducingheadlineinflation.

Butuncertaintiesremainandcentralbanksnowfacetwo-sidedrisks.Theymustavoidprematureeasingthatwouldundomanyhard-earnedcredibilitygainsandleadtoareboundininflation.Butsignsofstrainaregrowingininterestrate-sensitivesectors,suchasconstruction,andloanactivityhasdeclinedmarkedly.Itwillbeequallyimportanttopivottowardmonetarynormalizationintime,asseveralemergingmarketswhereinflationiswellonthewaydownhavestarteddoingsoalready.Notdoingsowouldjeopardizegrowthandriskinflationfallingbelowtarget.

MysenseisthattheUnitedStates,whereinflationappearsmoredemand-driven,needstofocusonrisksinthefirstcategory,whiletheeuroarea,wherethesurgeinenergypriceshasplayedadisproportionaterole,needstomanagemorethesecondrisk.Inbothcases,stayingonthepathtowardasoftlandingmaynotbeeasy.

Thebiggestchallengeaheadofusistotackleelevatedfiscalrisks.Mostcountriescameoutofthepandemicandenergycrisiswithhigherpublicdebtlevelsandborrowingcosts.Bringingdownpublicdebtanddeficitswillgivespacetodealwithfutureshocks.

Remainingfiscalmeasuresintroducedtooffsethighenergypricesshouldbephasedoutrightaway,astheenergycrisisisbehindus.Butmoreisneeded.Thedangeristwo-fold.Themostpressingriskisthatcountriesdotoolittle.Fiscalfragilitieswillbuildupuntiltheriskofafiscalcrisisforcessuddenanddisruptiveadjustments,atgreatcost.Theotherrisk,alreadyrelevantforsomecountries,istodotoomuch,toosoon,inthehopeofconvincingmarketsofones’fiscalrectitude.Thiscouldendangergrowthprospects.Itwouldalsomakeitmuchhardertoaddressimminentfiscalchallengessuchastheclimatetransition.

Whattodothen?Theansweristoimplementasteadyfiscalconsolidation,withanon-trivialfirstinstallment.Promisesoffutureadjustmentalonewillnotdo.Thisfirstinstallmentshouldbecombinedwithanimprovedandwell-enforcedfiscalframework,sofutureconsolidationeffortsarebothsizableandcredible.Asmonetarypolicystartstoeaseandgrowthresumes,itshouldbecomeeasiertodomore.Theopportunityshouldnotbewasted.

Emergingmarketshavebeenveryresilient,withstronger-than-expectedgrowthandstableexternalbalances,partlyduetoimprovedmonetaryandfiscalframeworks.Yetdivergenceinpolicybetweencountriesmayspurcapitaloutflowsandcurrencyvolatility.Thiscallsforstrongerbuffers,inlinewithour IntegratedPolicyFramework.

Beyondfiscalconsolidation,thefocusshouldreturntomedium-termgrowth.Weprojectglobalgrowthof3.2percentnextyear,stillwellbelowthehistoricalaverage.Afasterpaceisneededtoaddresstheworld’smanystructuralchallenges:theclimatetransition,sustainabledevelopment,andraisinglivingstandards.

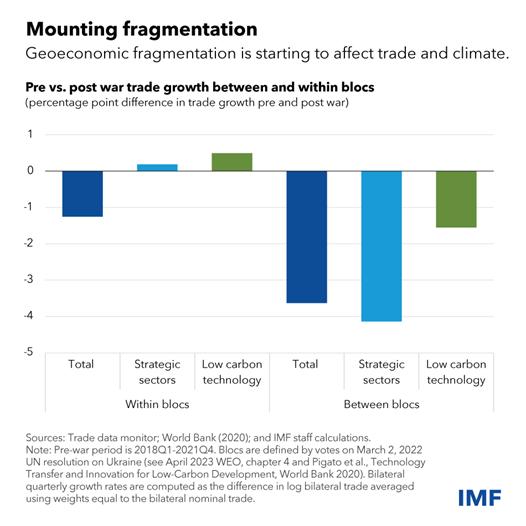

Reformsthateasethemostbindingconstraintstoeconomicactivity,suchasgovernance,businessregulationandexternalsectorreform,canhelpunleashlatentproductivitygains,ourresearchshows.Strongergrowthcouldalsocomefromlimitinggeoeconomicfragmentationby,forinstance,removingthetradebarriersthatareimpedingtradeflowsbetweendifferentgeopoliticalblocs,includinginlow-carbontechnologyproductsthatarecruciallyneededbyemerginganddevelopingcountries.

Instead,weshouldstrivetokeepoureconomiesmoreinterconnected.Onlybydoingsocanweworktogetheronsharedpriorities.Multilateralcooperationremainsthebestapproachtoaddressglobalchallenges.Progresstowardthat,suchastherecent 50percentincrease oftheFund’spermanentresources,iswelcome.

内容监制:董熙君

版面编辑|刘书廷

责任编辑|李锦璇、蒋旭

来源:IMI财经观察

责任编辑:石秀珍SF183