百时美施贵宝的期权:看看大笔资金在想什么

Deep-pocketedinvestorshaveadoptedabearishapproachtowardsBristol-MyersSquibb(NYSE:BMY),andit'ssomethingmarketplayersshouldn'tignore.OurtrackingofpublicoptionsrecordsatBenzingaunveiledthissignificantmovetoday.Theidentityoftheseinvestorsremainsunknown,butsuchasubstantialmoveinBMYusuallysuggestssomethingbigisabouttohappen.

WegleanedthisinformationfromourobservationstodaywhenBenzinga'soptionsscannerhighlighted21extraordinaryoptionsactivitiesforBristol-MyersSquibb.Thislevelofactivityisoutoftheordinary.

Thegeneralmoodamongtheseheavyweightinvestorsisdivided,with38%leaningbullishand57%bearish.Amongthesenotableoptions,8areputs,totaling$568,664,and13arecalls,amountingto$926,833.

PredictedPriceRange

TakingintoaccounttheVolumeandOpenInterestonthesecontracts,itappearsthatwhaleshavebeentargetingapricerangefrom$25.0to$55.0forBristol-MyersSquibboverthelast3months.

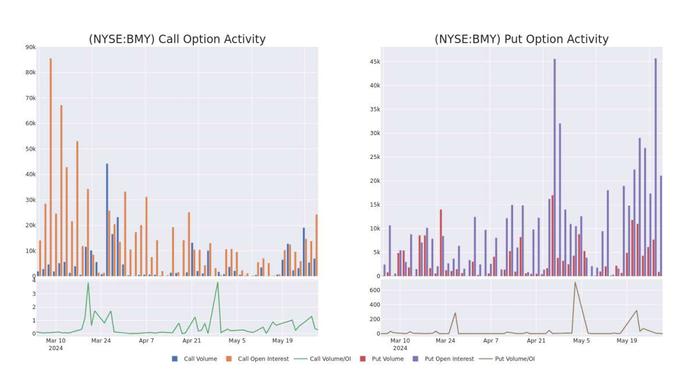

Volume&OpenInterestDevelopment

Lookingatthevolumeandopeninterestisaninsightfulwaytoconductduediligenceonastock.

ThisdatacanhelpyoutracktheliquidityandinterestforBristol-MyersSquibb'soptionsforagivenstrikeprice.

Below,wecanobservetheevolutionofthevolumeandopeninterestofcallsandputs,respectively,forallofBristol-MyersSquibb'swhaleactivitywithinastrikepricerangefrom$25.0to$55.0inthelast30days.

Bristol-MyersSquibb30-DayOptionVolume&InterestSnapshot

NoteworthyOptionsActivity:

SymbolPUT/CALLTradeTypeSentimentExp.DateAskBidPriceStrikePriceTotalTradePriceOpenInterestVolumeBMYCALLSWEEPBULLISH07/19/24$1.04$1.0$1.04$41.00$199.4K1.4K2.2KBMYCALLSWEEPBEARISH08/16/24$2.07$2.06$2.07$40.00$139.7K1.5K713BMYPUTSWEEPBEARISH09/20/24$6.25$6.15$6.25$46.00$136.8K1.5K1BMYPUTSWEEPBEARISH09/20/24$4.65$4.55$4.65$44.00$133.4K2.2K21BMYPUTSWEEPBEARISH09/20/24$4.2$4.1$4.2$43.00$125.6K3.1K300AboutBristol-MyersSquibb

Bristol-MyersSquibbdiscovers,develops,andmarketsdrugsforvarioustherapeuticareas,suchascardiovascular,cancer,andimmunedisorders.AkeyfocusforBristolisimmuno-oncology,wherethefirmisaleaderindrugdevelopment.Bristolderivescloseto70%oftotalsalesfromtheU.S.,showingahigherdependenceontheU.S.marketthanmostofitspeergroup.

AfterathoroughreviewoftheoptionstradingsurroundingBristol-MyersSquibb,wemovetoexaminethecompanyinmoredetail.Thisincludesanassessmentofitscurrentmarketstatusandperformance.

WhereIsBristol-MyersSquibbStandingRightNow?

Optionsareariskierassetcomparedtojusttradingthestock,buttheyhavehigherprofitpotential.Seriousoptionstradersmanagethisriskbyeducatingthemselvesdaily,scalinginandoutoftrades,followingmorethanoneindicator,andfollowingthemarketsclosely.