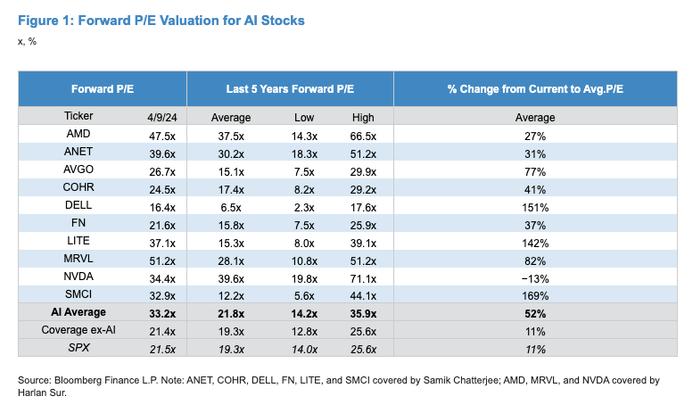

英伟达股票的交易价格比长期平均水平低13%,其他AI股票的溢价为52%

NvidiaCorp(NASDAQ:NVDA)traded13%belowitsfive-yearaverageasofApril9whilenineotherartificialintelligence-relatedstocksweretradingabovetheirfive-yearaverage.

TheAIaverageofall10stocksistradingata52%premium,accordingtoananalystnotefromJPMorgan'sSamikChatterjee,citingdatafromBloomberg.

Seebelow.

Ascanbeseeninthetableabove:

AlsoRead:WhichIsTheMostUndervaluedAI5StockRightNow?

AIStockPositioningEarnings

Despitethesector'sgrowthprospects,AIstocks,onaverage,aretradingata52%premiumtotheirlong-termvaluationmultiples.

Forcontext,theS&P500Index,consideredabarometeroftheU.S.stockmarket,iscurrently11%aboveitslong-termaverage.

Bythatmeasure,Nvidia,tradingat13%belowits5-yearaverageforwardP/Emultiple–appearstobegreatpick.AdvancedMicroDevices(NASDAQ:AMD)andAristaNetworks(NYSE:ANET)at27%and31%premium,respectively,mayalsobeofferingbettervaluethanotherAIstocks(ex-Nvidia).

ThepremiumonAIstocks'multiplesrightnow,isdefinitelyadampeneronenthusiasmforfavorablepositioningintoearnings.

Asinvestorsbraceforfirst-quarterearnings,navigatingmacroheadwindsandsector-specificdynamicsiscrucial.JPMorgan'sinsightsshedlightonpotentialopportunitiesandchallengesintheAIsector,guidinginvestorsinoptimizingtheirportfoliosamidstevolvingmarketconditions.

Image:Shutterstock