clean energy fuels(纳斯达克:CLNE)股东在过去一周内上涨了11%,但在过去三年仍然亏损。

ThisweekwesawtheCleanEnergyFuelsCorp.(NASDAQ:CLNE)sharepriceclimbby11%.Butoverthelastthreeyearswe'veseenaquiteseriousdecline.Inthattime,thesharepricedropped63%.Sotheimprovementmaybearealrelieftosome.Therisehassomehopeful,butturnaroundsareoftenprecarious.

Whilethestockhasrisen11%inthepastweekbutlongtermshareholdersarestillinthered,let'sseewhatthefundamentalscantellus.

GiventhatCleanEnergyFuelsdidn'tmakeaprofitinthelasttwelvemonths,we'llfocusonrevenuegrowthtoformaquickviewofitsbusinessdevelopment.Generallyspeaking,companieswithoutprofitsareexpectedtogrowrevenueeveryyear,andatagoodclip.That'sbecausefastrevenuegrowthcanbeeasilyextrapolatedtoforecastprofits,oftenofconsiderablesize.

Inthelastthreeyears,CleanEnergyFuelssawitsrevenuegrowby20%peryear,compound.That'swellabovemostotherpre-profitcompanies.Thesharepricehasmovedinquitetheoppositedirection,down18%overthattime,abadresult.Itseemslikelythatthemarketisworriedaboutthecontinuallosses.Butasharepricedropofthatmagnitudecouldwellsignalthatthemarketisoverlynegativeonthestock.

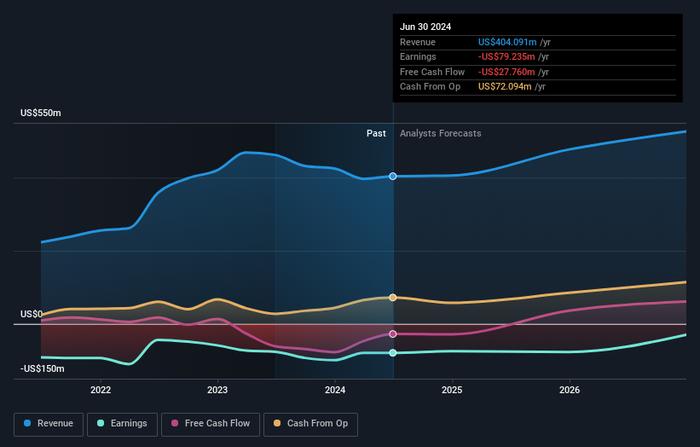

Youcanseebelowhowearningsandrevenuehavechangedovertime(discovertheexactvaluesbyclickingontheimage).

NasdaqGS:CLNEEarningsandRevenueGrowthSeptember14th2024

We'repleasedtoreportthattheCEOisremuneratedmoremodestlythanmostCEOsatsimilarlycapitalizedcompanies.It'salwaysworthkeepinganeyeonCEOpay,butamoreimportantquestioniswhetherthecompanywillgrowearningsthroughouttheyears.YoucanseewhatanalystsarepredictingforCleanEnergyFuelsinthisinteractivegraphoffutureprofitestimates.

ADifferentPerspective

InvestorsinCleanEnergyFuelshadatoughyear,withatotallossof32%,againstamarketgainofabout26%.Eventhesharepricesofgoodstocksdropsometimes,butwewanttoseeimprovementsinthefundamentalmetricsofabusiness,beforegettingtoointerested.Onthebrightside,longtermshareholdershavemademoney,withagainof7%peryearoverhalfadecade.Ifthefundamentaldatacontinuestoindicatelongtermsustainablegrowth,thecurrentsell-offcouldbeanopportunityworthconsidering.It'salwaysinterestingtotracksharepriceperformanceoverthelongerterm.ButtounderstandCleanEnergyFuelsbetter,weneedtoconsidermanyotherfactors.Considerrisks,forinstance.Everycompanyhasthem,andwe'vespotted2warningsignsforCleanEnergyFuelsyoushouldknowabout.

Ofcourse,youmightfindafantasticinvestmentbylookingelsewhere.Sotakeapeekatthisfreelistofcompaniesweexpectwillgrowearnings.

Pleasenote,themarketreturnsquotedinthisarticlereflectthemarketweightedaveragereturnsofstocksthatcurrentlytradeonAmericanexchanges.

Havefeedbackonthisarticle?Concernedaboutthecontent?Getintouchwithusdirectly.Alternatively,emaileditorial-team(at)simplywallst.com.

ThisarticlebySimplyWallStisgeneralinnature.Weprovidecommentarybasedonhistoricaldataandanalystforecastsonlyusinganunbiasedmethodologyandourarticlesarenotintendedtobefinancialadvice.Itdoesnotconstitutearecommendationtobuyorsellanystock,anddoesnottakeaccountofyourobjectives,oryourfinancialsituation.Weaimtobringyoulong-termfocusedanalysisdrivenbyfundamentaldata.Notethatouranalysismaynotfactorinthelatestprice-sensitivecompanyannouncementsorqualitativematerial.SimplyWallSthasnopositioninanystocksmentioned.