Capricor Therapeutics, Inc.(纳斯达克:CAPR)的股票上涨了31%,但其业务仍然落后于行业板块。

CapricorTherapeutics,Inc.(NASDAQ:CAPR)shareholdershavehadtheirpatiencerewardedwitha31%sharepricejumpinthelastmonth.Unfortunately,despitethestrongperformanceoverthelastmonth,thefullyeargainof7.6%isn'tasattractive.

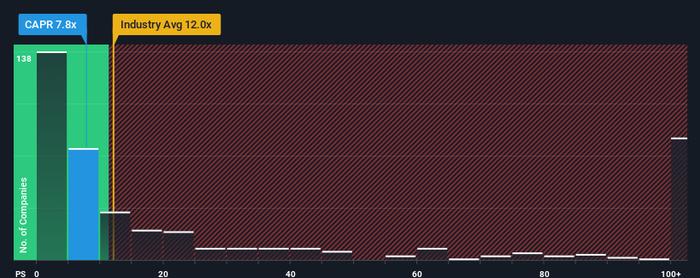

Inspiteofthefirmbounceinprice,CapricorTherapeutics'price-to-sales(or"P/S")ratioof7.8xmightstillmakeitlooklikeabuyrightnowcomparedtotheBiotechsindustryintheUnitedStates,wherearoundhalfofthecompanieshaveP/Sratiosabove12xandevenP/Sabove76xarequitecommon.Nonetheless,we'dneedtodigalittledeepertodetermineifthereisarationalbasisforthereducedP/S.

NasdaqCM:CAPRPricetoSalesRatiovsIndustrySeptember24th2024

WhatDoesCapricorTherapeutics'P/SMeanForShareholders?

CapricorTherapeuticscertainlyhasbeendoingagoodjoblatelyasit'sbeengrowingrevenuemorethanmostothercompanies.Itmightbethatmanyexpectthestrongrevenueperformancetodegradesubstantially,whichhasrepressedtheshareprice,andthustheP/Sratio.Ifnot,thenexistingshareholdershavereasontobequiteoptimisticaboutthefuturedirectionoftheshareprice.

Ifyou'dliketoseewhatanalystsareforecastinggoingforward,youshouldcheckoutour

free

reportonCapricorTherapeutics.

HowIsCapricorTherapeutics'RevenueGrowthTrending?

CapricorTherapeutics'P/Sratiowouldbetypicalforacompanythat'sonlyexpectedtodeliverlimitedgrowth,andimportantly,performworsethantheindustry.

Retrospectively,thelastyeardeliveredanexceptional187%gaintothecompany'stopline.Thelatestthreeyearperiodhasalsoseenanincredibleoverallriseinrevenue,aidedbyitsincredibleshort-termperformance.Therefore,it'sfairtosaytherevenuegrowthrecentlyhasbeensuperbforthecompany.

Lookingaheadnow,revenueisanticipatedtoclimbby55%peryearduringthecomingthreeyearsaccordingtothefiveanalystsfollowingthecompany.That'sshapinguptobemateriallylowerthanthe146%perannumgrowthforecastforthebroaderindustry.

Inlightofthis,it'sunderstandablethatCapricorTherapeutics'P/Ssitsbelowthemajorityofothercompanies.Apparentlymanyshareholdersweren'tcomfortableholdingonwhilethecompanyispotentiallyeyeingalessprosperousfuture.

WhatWeCanLearnFromCapricorTherapeutics'P/S?

Thelatestsharepricesurgewasn'tenoughtoliftCapricorTherapeutics'P/Sclosetotheindustrymedian.Typically,we'dcautionagainstreadingtoomuchintoprice-to-salesratioswhensettlingoninvestmentdecisions,thoughitcanrevealplentyaboutwhatothermarketparticipantsthinkaboutthecompany.

Aswesuspected,ourexaminationofCapricorTherapeutics'analystforecastsrevealedthatitsinferiorrevenueoutlookiscontributingtoitslowP/S.RightnowshareholdersareacceptingthelowP/Sastheyconcedefuturerevenueprobablywon'tprovideanypleasantsurprises.It'shardtoseethesharepricerisingstronglyinthenearfutureunderthesecircumstances.

Beforeyoutakethenextstep,youshouldknowaboutthe2warningsignsforCapricorTherapeuticsthatwehaveuncovered.

It'simportanttomakesureyoulookforagreatcompany,notjustthefirstideayoucomeacross.Soifgrowingprofitabilityalignswithyourideaofagreatcompany,takeapeekatthisfreelistofinterestingcompanieswithstrongrecentearningsgrowth(andalowP/E).

Havefeedbackonthisarticle?Concernedaboutthecontent?Getintouchwithusdirectly.Alternatively,emaileditorial-team(at)simplywallst.com.

ThisarticlebySimplyWallStisgeneralinnature.Weprovidecommentarybasedonhistoricaldataandanalystforecastsonlyusinganunbiasedmethodologyandourarticlesarenotintendedtobefinancialadvice.Itdoesnotconstitutearecommendationtobuyorsellanystock,anddoesnottakeaccountofyourobjectives,oryourfinancialsituation.Weaimtobringyoulong-termfocusedanalysisdrivenbyfundamentaldata.Notethatouranalysismaynotfactorinthelatestprice-sensitivecompanyannouncementsorqualitativematerial.SimplyWallSthasnopositioninanystocksmentioned.