应用光电公司(纳斯达克股票代码:AAOI)股价飙升60%,但其市盈率看起来仍然合理

AppliedOptoelectronics,Inc.(NASDAQ:AAOI)shareshavecontinuedtheirrecentmomentumwitha60%gaininthelastmonthalone.Thislatestsharepricebounceroundsoutaremarkable972%gainoverthelasttwelvemonths.

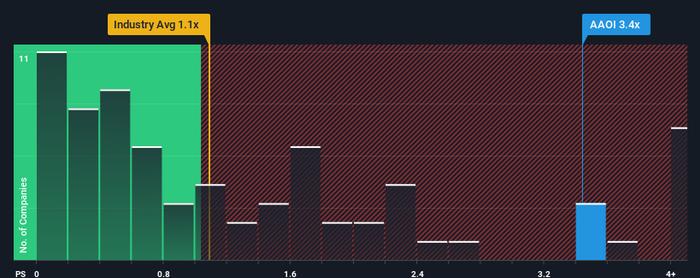

Aftersuchalargejumpinprice,givenaroundhalfthecompaniesintheUnitedStates'Communicationsindustryhaveprice-to-salesratios(or"P/S")below1.1x,youmayconsiderAppliedOptoelectronicsasastocktoavoidentirelywithits3.4xP/Sratio.Although,it'snotwisetojusttaketheP/Satfacevalueastheremaybeanexplanationwhyit'ssolofty.

ViewourlatestanalysisforAppliedOptoelectronics

NasdaqGM:AAOIPricetoSalesRatiovsIndustryDecember25th2023

WhatDoesAppliedOptoelectronics'P/SMeanForShareholders?

Recenttimeshaven'tbeengreatforAppliedOptoelectronicsasitsrevenuehasbeenrisingslowerthanmostothercompanies.OnepossibilityisthattheP/Sratioishighbecauseinvestorsthinkthislacklustrerevenueperformancewillimprovemarkedly.Ifnot,thenexistingshareholdersmaybeverynervousabouttheviabilityoftheshareprice.

KeentofindouthowanalyststhinkAppliedOptoelectronics'futurestacksupagainsttheindustry?Inthatcase,our

free

reportisagreatplacetostart.

DoRevenueForecastsMatchTheHighP/SRatio?

InordertojustifyitsP/Sratio,AppliedOptoelectronicswouldneedtoproduceoutstandinggrowththat'swellinexcessoftheindustry.

Takingalookbackfirst,weseethattherewashardlyanyrevenuegrowthtospeakofforthecompanyoverthepastyear.Thelackofgrowthdidnothingtohelpthecompany'saggregatethree-yearperformance,whichisanunsavory5.3%dropinrevenue.Sounfortunately,wehavetoacknowledgethatthecompanyhasnotdoneagreatjobofgrowingrevenueoverthattime.

Lookingaheadnow,revenueisanticipatedtoclimbby47%duringthecomingyearaccordingtothethreeanalystsfollowingthecompany.That'sshapinguptobemateriallyhigherthanthe0.4%growthforecastforthebroaderindustry.

Withthisinmind,it'snothardtounderstandwhyAppliedOptoelectronics'P/Sishighrelativetoitsindustrypeers.Itseemsmostinvestorsareexpectingthisstrongfuturegrowthandarewillingtopaymoreforthestock.

WhatWeCanLearnFromAppliedOptoelectronics'P/S?

AppliedOptoelectronics'P/Shasgrownnicelyoverthelastmonththankstoahandyboostintheshareprice.Typically,we'dcautionagainstreadingtoomuchintoprice-to-salesratioswhensettlingoninvestmentdecisions,thoughitcanrevealplentyaboutwhatothermarketparticipantsthinkaboutthecompany.

Aswesuspected,ourexaminationofAppliedOptoelectronics'analystforecastsrevealedthatitssuperiorrevenueoutlookiscontributingtoitshighP/S.RightnowshareholdersarecomfortablewiththeP/Sastheyarequiteconfidentfuturerevenuesaren'tunderthreat.Unlesstheseconditionschange,theywillcontinuetoprovidestrongsupporttotheshareprice.

Don'tforgetthattheremaybeotherrisks.Forinstance,we'veidentified3warningsignsforAppliedOptoelectronicsthatyoushouldbeawareof.

Ifcompanieswithsolidpastearningsgrowthisupyouralley,youmaywishtoseethisfreecollectionofothercompanieswithstrongearningsgrowthandlowP/Eratios.

Havefeedbackonthisarticle?Concernedaboutthecontent?Getintouchwithusdirectly.Alternatively,emaileditorial-team(at)simplywallst.com.

ThisarticlebySimplyWallStisgeneralinnature.Weprovidecommentarybasedonhistoricaldataandanalystforecastsonlyusinganunbiasedmethodologyandourarticlesarenotintendedtobefinancialadvice.Itdoesnotconstitutearecommendationtobuyorsellanystock,anddoesnottakeaccountofyourobjectives,oryourfinancialsituation.Weaimtobringyoulong-termfocusedanalysisdrivenbyfundamentaldata.Notethatouranalysismaynotfactorinthelatestprice-sensitivecompanyannouncementsorqualitativematerial.SimplyWallSthasnopositioninanystocksmentioned.