强势美元,悬在全球股市上方的一把利剑 A strong dollar is a sharp sword hanging above the global stock market

来源:华尔街见闻

最近,全球股市面临的利空因素较多,除了由供应减少和地缘政治不确定性加剧推动的油价上涨,以及美国财政担忧和“美联储更长时间保持利率高位”导致的美债收益率上升外,美元重新走强是需要消化的另一个因素。

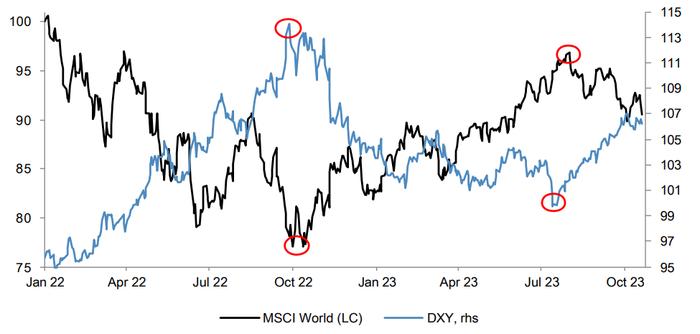

包括MislavMatejk在内的摩根大通股票策略师在周一的一份报告中指出,去年10月,美元的峰值与全球股市的低谷同时出现,而过去几个月全球股市的触底也与美元的见顶表现一致(见下图)。

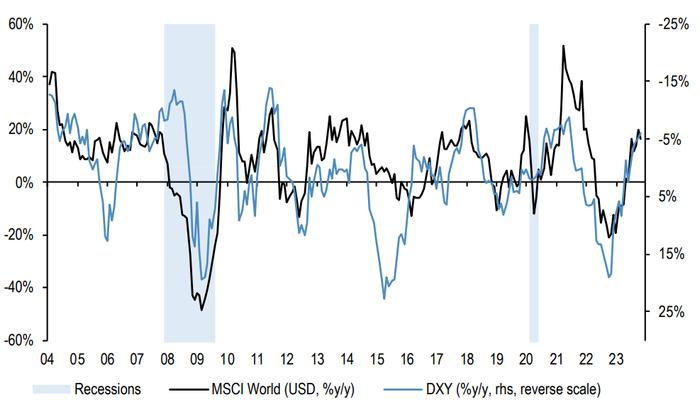

更重要的是,该行指出,在过去,当美元走强时,全球股市几乎总是处于压力之下。推动这一趋势的因素是,美联储在更长时间内保持利率高位、美国与多数国家之间的利差扩大,以及美国相对增长势头更强。

从长期来看,全球股市与美元表现出强烈的负相关关系。注:右轴美元指数为反向

报告写道:

“自美元在夏季触底以来,全球股市均走低,大致反映了历史模式。”

摩根大通在报告中表示,其外汇团队看好未来3-6个月美元相对于所有主要货币的走势,对新兴市场货币则持中性态度。该行认为,美国与多数国家之间“较大的利差暗示美元可能继续被看好。如果出现这种情况,全球股市整体可能继续承压。”

摩根大通:美元走强时期,新兴市场股市表现落后

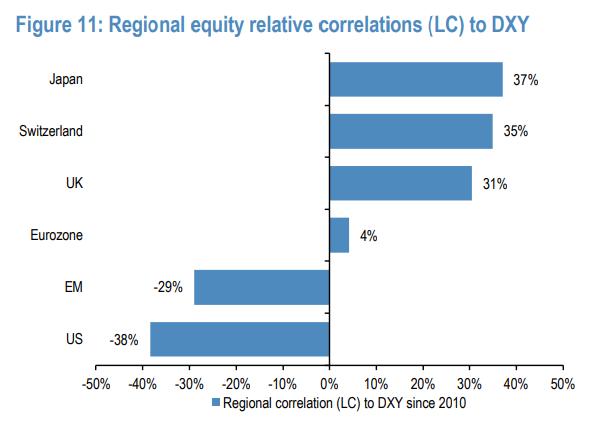

Matejk等策略师分析称,从以本币计算的回报来看,美元走强总体上有利于日本、英国和瑞士等市场。也就是,当美元上涨时,日本、瑞士和英国股市往往表现更好。另一方面,美国和新兴市场股市表现不佳。

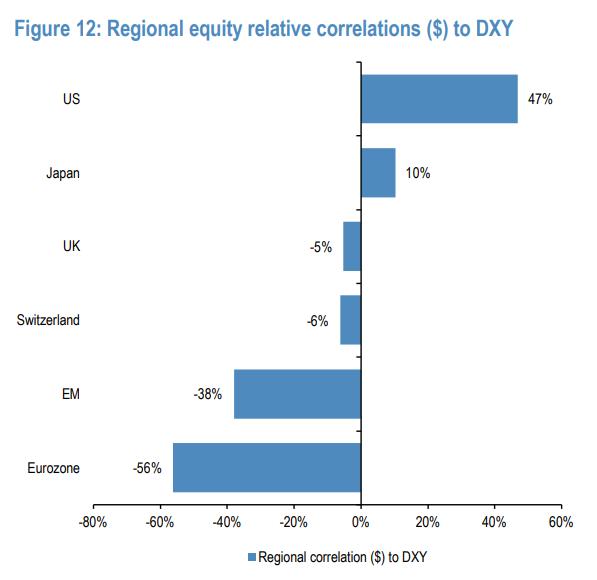

报告称,如果采用同样的分析方法,但使用美元回报率,排名顺序会发生变化。不出所料,美国股市高居榜首,日本股市依然表现优异。英国和瑞士失去了相对优异的表现,新兴市场仍然落后。而欧元区股票垫底。

报告写道:

“今年到目前为止,新兴市场股市的回报率比发达市场整体低10%左右。”

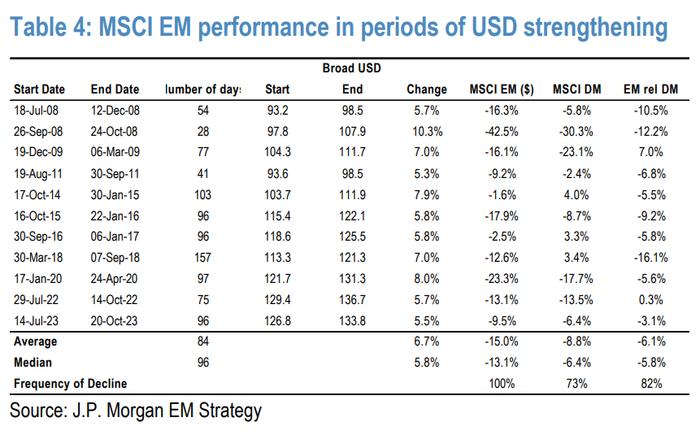

在回顾过去15年的美元强势时期后,摩根大通指出,每当美元指数上涨超过5%时,新兴市场股票以美元计价的回报率都是负值。

从全球股票策略的角度,摩根大通重申了对新兴市场股票相对于发达市场的谨慎立场。该行指出,美联储对于利率“highforlonger”的措辞,也制约了新兴市场股市的前景。

Source:WallStreet

Recently,globalstockmarketshavefacedanumberofnegativefactors,inadditiontotheriseinoilpricesdrivenbyreducedsupplyandincreasedgeopoliticaluncertainty,aswellashigherUSbondyieldscausedbyUSfiscalconcernsand"theFederalReservekeepsinterestrateshighforlonger".Therenewedstrengthofthedollarisanotherfactortobedigested.

JPMorganChase&Costockstrategist,includingMislavMatejk,pointedoutinareportonMonday.LastOctober,thepeakofthedollarcoincidedwiththetroughofglobalstockmarkets,andthebottomingofglobalstockmarketsinthepastfewmonthswasconsistentwiththepeakperformanceofthedollar.(seefigurebelow).

Moreimportantly,thebankpointedoutInthepast,whenthedollarstrengthened,globalstockmarketswerealmostalwaysunderpressure.ThistrendisdrivenbytheFed'slonger-termhighinterestrates,wideningspreadsbetweentheUSandmostcountries,andstrongerrelativegrowthintheUS.

Inthelongrun,globalstockmarketsshowastrongnegativecorrelationwiththedollar.Note:theright-axisdollarindexisinreverse.

Thereportsays:

"Globalstockmarketshavefallensincethedollarbottomedinthesummer,roughlyreflectinghistoricalpatterns."

JPMorganChase&Cosaidinthereportthathisforeignexchangeteamwasbullishonthetrendofthedollaragainstallmajorcurrenciesoverthenextthreetosixmonthsandwasneutraltowardsemergingmarketcurrencies.ThebankbelievesthatThe"largespread"betweentheUnitedStatesandmostcountriessuggeststhatthedollarmaycontinuetobebullish.Ifthathappens,globalstockmarketsasawholearelikelytoremainunderpressure."

JPMorganChase&Co:emergingmarketstockmarketslaggedbehindduringthestrengtheningdollar

StrategistssuchasMatejkanalyzedIntermsofreturnsinlocalcurrencyterms,astrongerdollarisgenerallygoodformarketssuchasJapan,theUKandSwitzerland.Thatis,whenthedollarrises,Japanese,SwissandBritishstockmarketstendtoperformbetter.Ontheotherhand,stocksintheUSandemergingmarketshaveperformedpoorly.

Thereportsaysthatifthesamemethodofanalysisisused,Butusingdollarreturns,therankingorderwillchange.Asexpected,theUSstockmarkettoppedthelist,whiletheJapanesestockmarketstillperformedwell.TheUKandSwitzerlandhavelosttheirrelativelyexcellentperformance,whileemergingmarketsstilllagbehind.Euro-zonestocksareatthebottom.

Thereportsays:

"sofarthisyear,emergingmarketequitieshavereturnedabout10percentlowerthandevelopedmarketsasawhole."

Afterreviewingtheperiodofdollarstrengthoverthepast15yearsJPMorganChase&CopointedoutWheneverthedollarindexrisesbymorethan5%,emergingmarketstocksreturnnegativeindollarterms.

FromtheperspectiveofglobalequitystrategyJPMorganChase&Coreiteratedhiscautiouspositiononemergingmarketstocksrelativetodevelopedmarkets.ThebanknotedthattheFed'swordingof"highforlonger"ininterestratesalsoconstrainedtheoutlookforemergingmarketequities.