“原油—成品油/石脑油—化工品”谁是链上的老大?

来源:聚酯PTA乙二醇短纤投研根据地

PleasenotethatthefullEnglishtranslationisattheend.

在研究石脑油套期保值和加工利润套期保值的过程中,总结归纳了一些关于石脑油的问题。对于石脑油,从未实盘操作过,下面文字如有思虑不周之处,敬请批评指正。

摘要

成品油需求会影响石脑油的供应数量、成本水平、化工下游开工。

化工利润(石脑油→化工品)受成品油利润(原油→成品油)的影响很大;成品油利润与化工利润基本负相关。

成品油利润(原油→成品油)与石脑油利润(原油→石脑油)基本负相关。

石脑油的两个特点

石脑油占油品的份额小

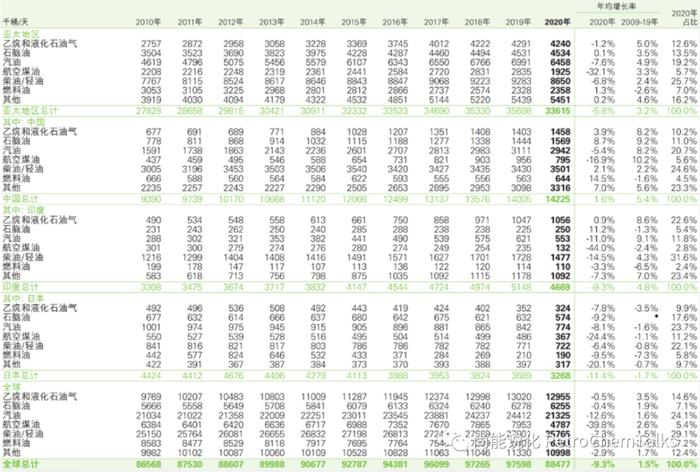

炼油的下游油品中,石脑油的份额小:中国11%,亚太13%,全球7%。而汽柴煤油的一般占比在50%~60%左右。

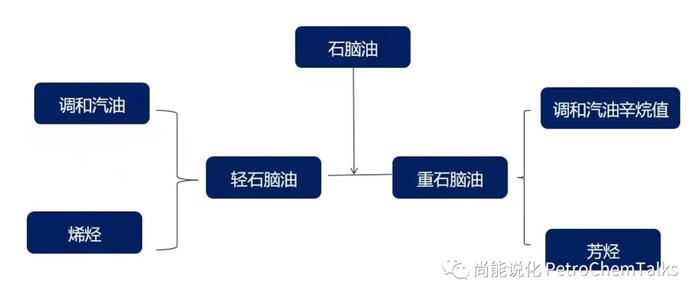

石脑油既能裂解也能调油

石脑油以及其他的一些烷烃和芳烃具有二元性特征:不仅可以作为裂解原料去生产烯烃等化工产品,也可以用于调油(包括炼厂和调油贸易商)去生产汽油等能源产品。

调制汽油的原料

直馏汽油(石脑油、石油醚),轻质石脑油,凝析油(轻烃),精制C5、C9、C10化工油,芳烃150#、200#,混合芳烃,甲醛脂,MTBE,DMC,高碳醇等。

调制柴油的原料

重柴油,蜡油,焦化蜡油,200#以上的溶剂油,重芳烃,C8、C9、C10、C11、C12、C13、C14、C15,航空炼油。灯用煤油,常线油,减一线油,200#、230#、270#芳烃溶剂油,3#矿物油,地炼柴油,裂解柴油,焦化柴油等。

正文

简化起见,先不考虑原油和成品油的供给冲击,只考虑成品油需求(利润)波动造成的成品油价格和加工利润的变化。

1、成品油利润影响石脑油供应:成品油利润对于石脑油供应的影响从两方面展开:排产比例和炼厂总体开工率。

A.排产比例

成品油利润好,成品油排产比例上升,石脑油排产比例减少,石脑油和调油组分(芳烃类、高烷烃等)会较多地去成品油,都会减少石脑油的供应。

而且,因为石脑油占油品的份额低,所以排产和调油造成的成品油产出比例的小幅调整,比如1~2%,就将造成石脑油供应10~20%的波动。

因此,造成石脑油和其他化工单体原料供应端较大的波动,从而造成它们价格的大幅波动。

成品油通过排产比例影响石脑油的价格,成品油高利润→成品油高排产比例→石脑油低排产比例→石脑油高价格,是正相关的关系。

【案例】在2022年5月第一个成品油利润高峰时,石脑油和PTA的价格都达到了年内高位。

B.炼厂总体开工率

成品油因为占油品的份额高,所以成品油利润的高低又决定着炼厂的总体开工率。成品油利润较好时,炼厂会提高开工率,同样也会增加石脑油的供应。因此,石脑油和其他化工原料的供应增加会相对明显,从而造成石脑油价格降低。

成品油通过炼厂开工负荷影响石脑油的价格,成品油高利润→炼厂高开工率→石脑油高供应→石脑油低价格,又是负相关的关系。

【案例】2022年下半年开始,轻重石脑油价格的劈叉。炼厂的高开工造成轻重石脑油的产量增加,一方面重石脑油的调辛烷值功能和生产的芳烃有调油需求,重石脑油价格持续上涨;另一方面轻石脑油由于产量也同步增加,但是乙烯裂解装置因为经济性原因需求不好,轻石脑油价格降低。

可以将A路径理解为竞争品关系,将B路径理解为副产品关系。至于哪种关系起主要作用,还是要看A和B哪一种路径对石脑油供应造成更多的影响。

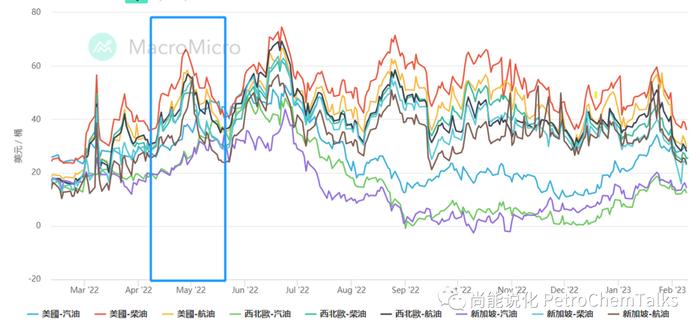

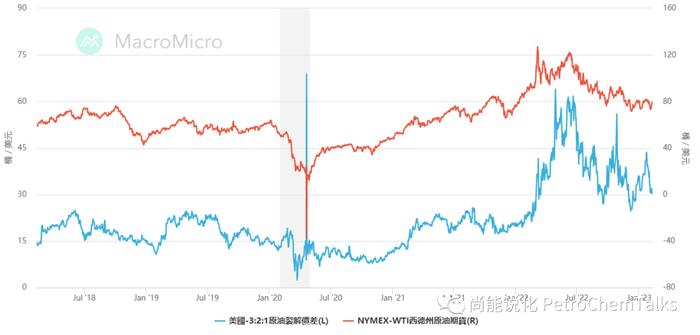

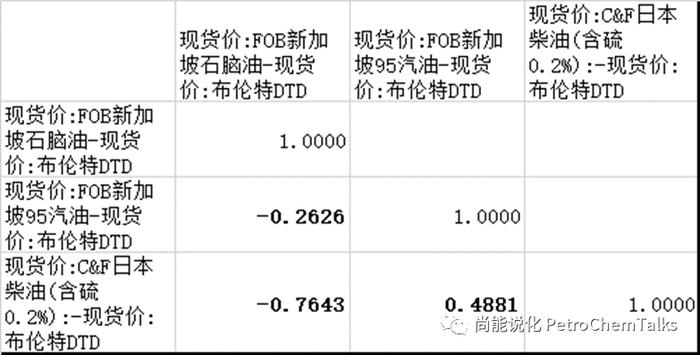

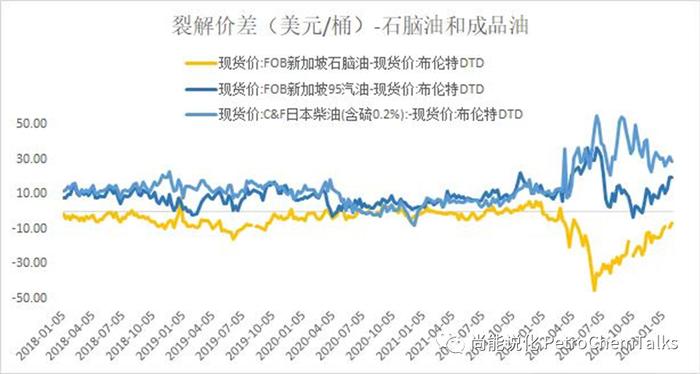

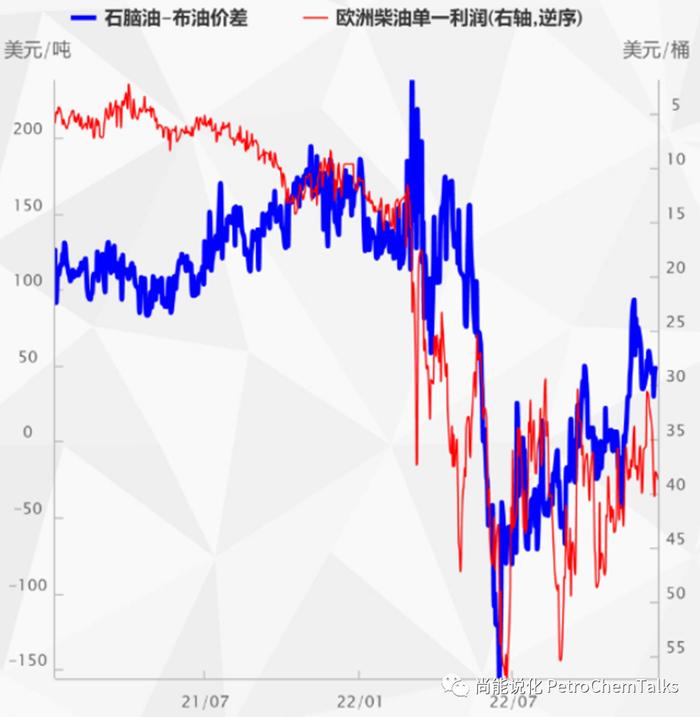

2、成品油利润影响石脑油成本:成品油需求旺盛,利润上升,价格上涨。成品油是原油最主要的下游,当成品油的需求和价格上升,也会导致原油价格上涨。成品油裂解价差(下图红线)与原油价格(下图蓝线)的关系如下,近一年的正相关关系更为明显。而由于成品油裂解价差导致的原油价格上涨同时也会推升石脑油等化工原料的价格。

成品油通过原油需求影响石脑油的价格,成品油高利润→原油需求增加→原油高价格→石脑油高成本,是正相关的关系。

2018-至今

2022-至今

注:传统裂解以3桶WTI原油炼制2桶汽油(RBOB)以及1桶加热用燃油(HO)为基准,传统裂解“价差”=(RBOB 汽油的每桶价格*2+HO热用燃油的每桶价格*1-WTI原油的每桶价格*3。热用燃油可以视作柴油。

从炼油厂预期到实际购买及炼油会有1个月以上的时间差,因此裂解价差通常会领先油价。用油旺季:汽油或燃油库存减少、价格上涨→裂解价差扩大,炼油厂增加原油需求,原油价格上涨。用油淡季:汽油或燃油库存增加、价格下跌→裂解价差收敛,炼油厂减少原油需求,原油价格下跌。

3、成品油下游刚于石脑油下游:成品油需求旺盛,利润上升,价格上涨,石脑油价格跟涨,但是下游对高价的承接能力不一样。成品油对应的下游——能源、出行需求更为刚性,价格承接力更强。石脑油和其他化工原料对应的下游——工业需求相对弹性较大,价格承接力较差。

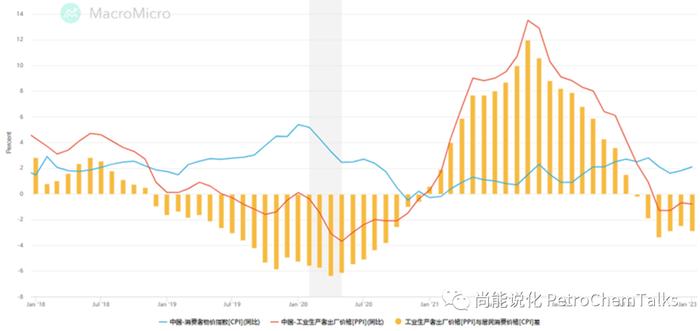

成品油价格波动对应的是CPI,石脑油价格、化工产品价格波动对应的是PPI。PPI(下图红线)相对CPI(下图蓝线)更为波动,因为PPI更多对应企业部门,CPI更多对应居民部门。企业利润扩展或者亏损加剧,会更迅速地往上反馈到对生产原料的需求。同样的,原料成本上升或者下降,也会更容易往下传导到企业的盈亏波动。

因此,石脑油等化工原料的下游需求相对于成品油的下游需求,对价格更为敏感,即原料价格上涨后如果导致总体生产运营亏损,企业更容易通过降低开工率去减少采购需求,从而对石脑油价格进行负反馈。

然而,因为石脑油份占油品的份额小,并且可以由化工转为去调油,所以这种负反馈往上传导到炼厂可以“轻松”地被成品油吸纳,对炼厂的总体开工负荷影响很小。因此,炼厂也不会因为这种负反馈而去调整石脑油价格。相比之下,成品油占油品的份额大得多,并且下游的能源、出行需求更为刚性,所以负反馈的能力和价格承接的能力更强。

所以,我们推测:

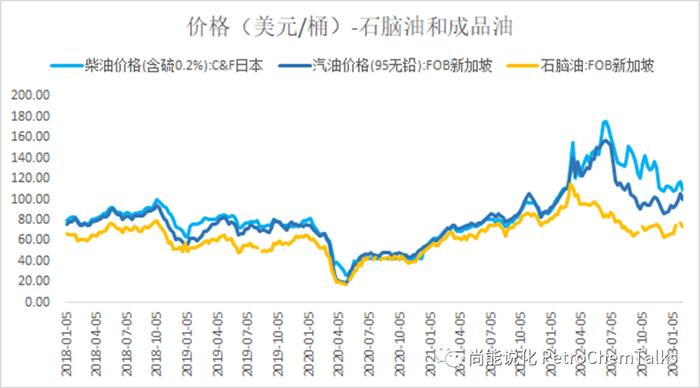

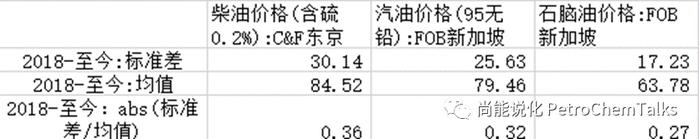

石脑油的价格波动远小于成品油,尤其是石脑油的涨幅远小于成品油。下图的标准差均值比证明了我们的推测。

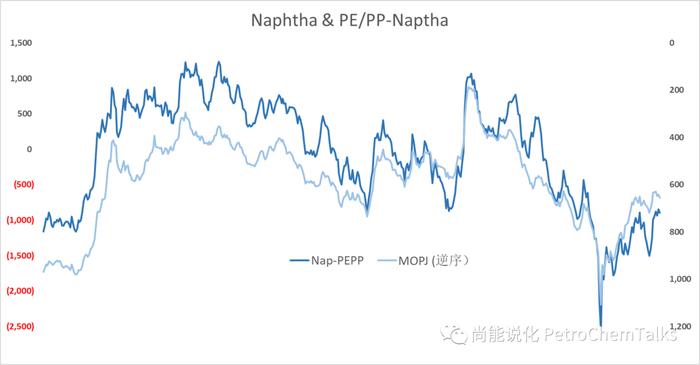

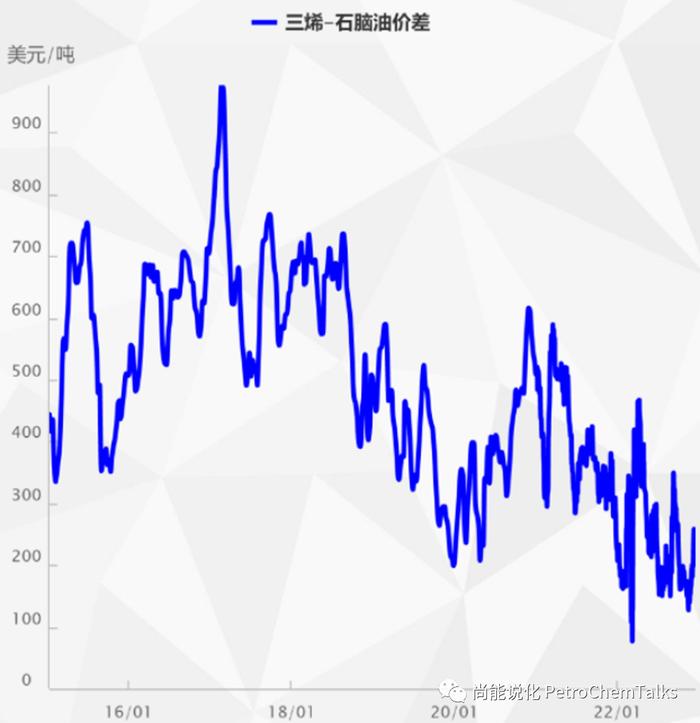

成品油下游对高价的承接力强于石脑油下游,因此成品油加工利润可以较好保持,而化工利润(即化工企业高生产利润)较难保持。下图的化工企业生产利润(以聚烯烃-石脑油为表征)基本和石脑油价格高度负相关。

通过上面的论述,我们可以总结:

成品油需求影响石脑油供应:从排产比例和炼厂开工两个方面一正一负地通过影响石脑油供应去作用到石脑油的价格。

成品油需求影响石脑油成本:成品油裂解利润与油价正相关,与石脑油价格正相关。

成品油需求刚性大于石脑油:成品油价格波动更大,下游需求更为刚性,价格承接力更强。相比之下,石脑油价格波动较小,下游需求弹性较大,价格承接力较弱。

结论

1、成品油利润与化工利润基本呈负相关

成品油利润好、需求好、价格高,导致石脑油价格高,但下游化工品对高价承接力弱,化工利润降低。

也有正相关的时候,比如在2022年三季度,成品油加工利润和化工利润同时下降,主要原因是市场大幅交易加息引起美国衰退和经济硬着陆,以及能源通胀对欧洲产出和需求的压制。

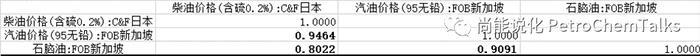

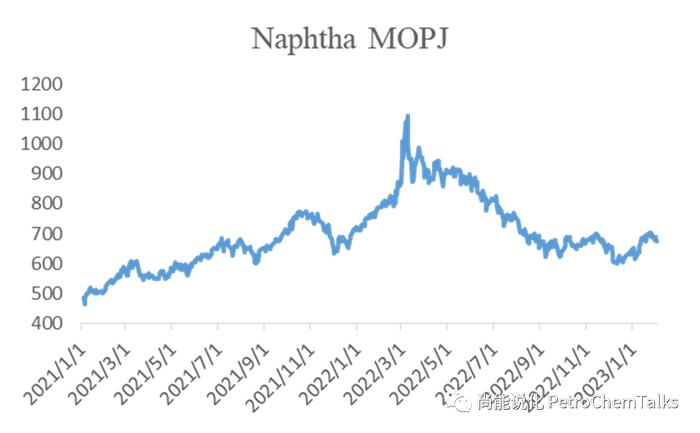

能化-SC近似代替化工利润,因为相对于高波动的原油价格而言,Nap裂解价差是相对稳定的变量,所以用SC代替Nap也合理。Nap=原油+裂解价差,Nap基本由原油的价格和波动决定。

2、成品油利润与石脑油利润基本呈负相关

化工下游化工产品首先进行负反馈,将阻止石脑油价格的上升,进而影响石脑油的加工利润。

如果化工产品的PPI可以成功向下传导到制品的CPI,负反馈会减少,石脑油价格会重拾升势。

如果上游原油向下的成本传导非常剧烈,比如原油因为战争地缘等原因,价格持续上涨,石脑油价格也将被动抬升。

3、炼厂可以承受石脑油较大的加工利润波动

作为小份额副产品的石脑油,炼厂可以“忍受”负的加工利润(类似高硫燃料油)。

2022年的市场表现

成品油需求涨、价格涨、加工利润涨,石脑油价格高

⬇

化工下游基本面需求差,而石脑油价格高,化工原料成本高,化工利润为负

⬇

化工链条负反馈到石脑油,石脑油加工利润与价格同跌

化工链条利润并非只由成本端的石脑油决定,也会受化工品自身供需面影响。

首先,石脑油由于下游负反馈并没有价格大涨,成品油加工利润与石脑油的加工利润以及化工产业利润都呈现负相关。

其次,成品油利润太好,炼厂火力全开,作为“副产品”的石脑油产量也很高,所以A.石脑油的供应端相对来说还是较为充分,B.石脑油的需求端化工产品的需求差造成化工品价格低,化工生产利润下滑,化工企业开工降低,造成对石脑油的需求减少。

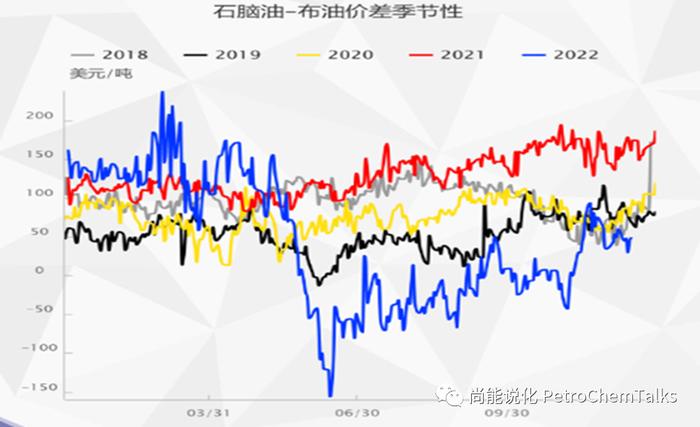

A和B都造成了石脑油价格下跌,石脑油的绝对价格在2022年跌到了较低位置,相对价格于布油的价差也在季节低位。

“原油—成品油/石脑油—化工品”谁是链上的老大?

在不考虑地缘冲突/原油供给冲击的影响下,总量、价格、利润、波动,还是成品油说了算。

Intheprocessofstudyingnaphthahedgingandprocessingprofithedging,someproblemsaboutnaphthaaresummarized.Fornaphtha,ithasneverbeenoperatedinrealoperation,andifthefollowingtextisnotthoughtful,pleasecriticizeandcorrect.

Summary

Demandforrefinedoilproductswillaffectthesupplyquantityofnaphtha,costlevel,anddownstreamstartofchemicalindustry.

Chemicalprofits(naphtha→chemicals)aregreatlyaffectedbyrefinedoilprofits(crudeoil→refinedoil);Theprofitofrefinedoilisbasicallynegativelycorrelatedwiththeprofitofchemicalindustry.

Refinedoilprofits(crudeoil→refinedproducts)arebasicallynegativelycorrelatedwithnaphthaprofits(crudeoil→naphtha).

Twocharacteristicsofnaphtha

Naphthaaccountsforasmallshareofoilproducts

Theshareofnaphthainthedownstreamoilproductsofrefiningissmall:11%inChina,13%inAsiaPacificand7%globally.Thegeneralproportionofgasolinedieselkeroseneisabout50%~60%.

Naphthacanbothcrackandrefineoil

Naphthaandsomeotheralkanesandaromaticshavebinarycharacteristics:notonlycanitbeusedasacrackingrawmaterialtoproducechemicalproductssuchasolefins,butalsoforoilblending(includingrefineriesandoilblendingtraders)toproduceenergyproductssuchasgasoline.

Rawmaterialsforpreparinggasoline

Straight-rungasoline(naphtha,petroleumether),lightnaphtha,condensate(lighthydrocarbon),refinedC5,C9,C10chemicaloil,aromatichydrocarbon150#,200#,mixedaromatichydrocarbon,formaldehydelipid,MTBE,DMC,highcarbonalcohol,etc.

Rawmaterialsforpreparingdiesel

Heavydiesel,waxoil,cokingwaxoil,solventoilabove200#,heavyaromatics,C8,C9,C10,C11,C12,C13,C14,C15,aviationrefining.Keroseneforlamps,constantlineoil,minusonelineoil,200#,230#,270#aromaticsolventoil,3#mineraloil,groundrefiningdiesel,pyrolysisdiesel,cokingdiesel,etc.

Body

Forthesakeofsimplification,thesupplyshockofcrudeoilandrefinedoilisnotconsidered,andonlythechangesinrefinedoilpricesandprocessingprofitscausedbyfluctuationsinrefinedoildemand(profit)areconsidered.

1.Refinedoilprofitsaffectnaphthasupply:Theimpactofrefinedoilprofitsonnaphthasupplystartsfromtwoaspects:theproductionratioandtheoveralloperatingrateofrefineries.

A.Schedulingratio

Theprofitofrefinedoilisgood,theproportionofrefinedoilproductionincreases,theproportionofnaphthaproductionisreduced,andnaphthaandoilblendingcomponents(aromatics,highalkanes,etc.)willgotorefinedoilmore,whichwillreducethesupplyofnaphtha.

Moreover,becausenaphtha'sshareofoilproductsislow,asmalladjustmentintheproportionofrefinedoiloutputcausedbyschedulingandoiladjustment,suchas1~2%,willcauseafluctuationof10~20%innaphthasupply.

Asaresult,largefluctuationsinthesupplysideofnaphthaandotherchemicalmonomerrawmaterialshaveoccurred,resultinginlargefluctuationsintheirprices.

Thehighprofitofrefinedoilproducts→thehighschedulingratioofrefinedoil→thelowschedulingratioofnaphtha→thehighpriceofnaphtha,arepositivelycorrelated.

【Case】AtthefirstpeakofrefinedoilprofitinMay2022,thepricesofbothnaphthaandPTAreachedthehighleveloftheyear.

B.Overallrefineryoperatingrate

Becauserefinedoilproductsaccountforahighshareofoilproducts,thelevelofrefinedoilprofitsdeterminestheoveralloperatingrateoftherefinery.Whenrefinedoilmarginsarebetter,refinerieswillincreaseoperatingrates,whichwillalsoincreasethesupplyofnaphtha.Therefore,theincreaseinthesupplyofnaphthaandotherchemicalrawmaterialswillberelativelyobvious,resultinginadecreaseinthepriceofnaphtha.

Refinedoilproductsaffectthepriceofnaphthathroughrefineryoperatingload,andtherelationshipbetweenhighprofitabilityofrefinedoilproducts→highoperatingrateof→highsupplyofnaphtha→lowpriceofnaphtha.

【Case】Startinginthesecondhalfof2022,thepriceoflightandheavynaphthawillsplit.Thehighoperationoftherefineryhasledtoanincreaseintheproductionoflightandheavynaphtha,ontheonehand,theoctanefunctionofheavynaphthaandthearomatichydrocarbonsproducedhaveoildiversiondemand,andthepriceofheavynaphthacontinuestorise;Ontheotherhand,theproductionoflightnaphthahasalsoincreasedsimultaneously,butthedemandforethylenecrackersisnotgoodduetoeconomicreasons,andthepriceoflightnaphthahasdecreased.

TheApathcanbeunderstoodasacompetitorrelationship,andtheBpathasaby-productrelationship.Asforwhichrelationshipplaysamajorrole,itdependsonwhichpathAandBhavemoreimpactonnaphthasupply.

2.Refinedoilprofitsaffectthecostofnaphtha:thedemandforrefinedoilproductsisstrong,profitsarerising,andpricesarerising.Refinedoilproductsarethemostimportantdownstreamofcrudeoil,andwhenthedemandandpriceofrefinedoilrise,itwillalsoleadtohighercrudeoilprices.Therelationshipbetweentherefinedoilcrackingspread(redlinebelow)andcrudeoilprices(bluelinebelow)isasfollows,andthepositivecorrelationinthepastyearismoreobvious.Theriseincrudeoilpricesduetothecrackingspreadofrefinedoilwillalsopushupthepriceofchemicalrawmaterialssuchasnaphtha.

Refinedoilproductsaffectthepriceofnaphthathroughcrudeoildemand,andthehighprofitofrefinedoil→theincreaseincrudeoildemand→thehighpriceofcrudeoil→thehighcostofnaphthaarepositivelycorrelated.

Note:Traditionalcrackingisbasedon3barrelsofWTIcrudeoilrefining2barrelsofgasoline(RBOB)and1barrelofheatingfueloil(HO),andthetraditionalcracking"spread"=(priceperbarrelofRBOBgasoline*2+priceperbarrelofHOhotfuel*priceperbarrelof1-WTIcrudeoil*3.Hotfueloilcanbethoughtofasdiesel.

Thereisatimelagofmorethan1monthfromthetimetherefineryexpectstoactuallybuyandrefine,sothecrackspreadusuallyleadstheoilprice.Peakseason:Gasolineorfueloilinventoriesdecrease,pricesrise→crackingspreadswiden,refineriesincreasecrudeoildemand,andcrudeoilpricesrise.Off-season:Gasolineorfueloilinventoriesincrease,pricesfall→crackingspreadsconverge,refineriesreducecrudeoildemand,andcrudeoilpricesfall.

3.Thedownstreamofrefinedoilproductsisjustbelowthedownstreamofnaphtha:thedemandforrefinedoilisstrong,profitsarerising,pricesarerising,andthepriceofnaphthaisrising,butthedownstreamcapacitytoundertakehighpricesisnotthesame.Thedownstream-energyandtraveldemandcorrespondingtorefinedoilproductsismorerigid,andthepriceacceptanceforceisstronger.Thedownstream-industrialdemandcorrespondingtonaphthaandotherchemicalrawmaterialsisrelativelyelastic,andthepriceacceptanceispoor.

ThepricefluctuationofrefinedoilcorrespondstoCPI,andthepricefluctuationofnaphthaandchemicalproductscorrespondstoPPI.PPI(redlinebelow)ismorevolatilethanCPI(bluelinebelow)becausePPIcorrespondsmoretothecorporatesectorandCPImoretotheresidentialsector.Theexpansionofcorporateprofitsortheaggravationoflosseswillmorequicklyfeedbackupwardstothedemandforproductionrawmaterials.Similarly,risingorfallingrawmaterialcostswillbemoreeasilytransmitteddownwardtothecompany'sprofitandlossfluctuations.

Therefore,thedownstreamdemandforchemicalrawmaterialssuchasnaphthaismoresensitivetopricethanthedownstreamdemandforrefinedoil,thatis,ifthepriceofrawmaterialsrisesandleadstooverallproductionandoperationlosses,itiseasierforenterprisestoreduceprocurementdemandbyreducingtheoperatingrate,therebygivingnegativefeedbacktothepriceofnaphtha.

However,becausenaphthaaccountsforasmallshareofoilproducts,andcanbeconvertedfromchemicaltode-blending,thisnegativefeedbackcanbetransmittedupwardtotherefineryandcanbe"easily"absorbedbyrefinedoil,withlittleimpactontheoveralloperatingloadoftherefinery.Therefore,refinerswillnotadjustnaphthapricesbecauseofthisnegativefeedback.Incontrast,refinedoilaccountsforamuchlargershareofoilproducts,anddownstreamenergyandtraveldemandismorerigid,sotheabilitytonegativelyfeedbackandtheabilitytoundertakepricesarestronger.

So,wespeculate:

Thepricevolatilityofnaphthaismuchsmallerthanthatofrefinedoil,andtheincreaseinnaphthainparticularismuchsmallerthanthatofrefinedoil.Themeanratioofstandarddeviationsinthefigurebelowprovesourconjecture.

Thedownstreamofrefinedoilproductshasastrongerbearingforceforhighpricesthanthedownstreamofnaphtha,sotheprofitofrefinedoilprocessingcanbebettermaintained,whiletheprofitofchemicalproducts(thatis,thehighproductionprofitofchemicalenterprises)ismoredifficulttomaintain.Theproductionprofitsofchemicalcompaniesinthefigurebelow(characterizedbypolyolefin-naphtha)arebasicallyhighlynegativelycorrelatedwithnaphthaprices.

Fromtheabovediscussion,wecansummarize:

Refinedoildemandaffectsnaphthasupply:fromthetwoaspectsofschedulingratioandrefineryoperation,itaffectsthepriceofnaphtha.

Refinedoildemandaffectsnaphthacosts:refinedoilcrackingprofitsarepositivelycorrelatedwithoilpricesandpositivelycorrelatedwithnaphthaprices.

Thedemandforrefinedoilismorerigidthannaphtha:thepriceofrefinedoilfluctuatesgreater,thedownstreamdemandismorerigid,andthepriceacceptanceisstronger.Incontrast,thepriceofnaphthaislessvolatile,thedownstreamdemandelasticityislarge,andthepricecarryingforceisweak.

Conclusion

1.Theprofitofrefinedoilandtheprofitofchemicalindustryarebasicallynegativelycorrelated

Theprofitofrefinedoilproductsisgood,thedemandisgood,andthepriceishigh,resultinginhighnaphthaprices,butthedownstreamchemicalshaveaweakabilitytoundertakehighprices,andchemicalprofitsarereduced.

Therearealsopositivecorrelationtimes,suchasinthethirdquarterof2022,whenrefinedoilprocessingprofitsandchemicalprofitsfellatthesametime,mainlyduetotherecessionandeconomichardlandingintheUnitedStatescausedbysharpmarkettradingratehikes,aswellasthesuppressionofEuropeanoutputanddemandbyenergyinflation.

Energical-SCapproximatesthereplacementofchemicalprofits,becausetheNappcrackingspreadisarelativelystablevariablerelativetohighlyvolatilecrudeoilprices,soitisreasonabletoreplaceNapwithSC.NAP=crudeoil+crackingspread,Napisbasicallydeterminedbythepriceandvolatilityofcrudeoil.

2.Theprofitofrefinedoilandtheprofitofnaphthaarebasicallynegativelycorrelated

Thefirstnegativefeedbackofchemicaldownstreamchemicalproductswillpreventtheriseinthepriceofnaphtha,whichinturnwillaffecttheprocessingprofitofnaphtha.

IfthePPIofchemicalproductscanbesuccessfullytransmitteddowntotheCPIofproducts,thenegativefeedbackwillbereducedandthepriceofnaphthawillresumeitsupwardtrend.

Ifthedownstreamcosttransmissionofcrudeoilisveryviolent,suchasthepriceofcrudeoilduetowargeography,etc.,thepriceofnaphthawillalsorisepassively.

3.Therefinerycanwithstandlargefluctuationsintheprocessingprofitofnaphtha

Asasmallshareofnaphtha,abyproduct,refinerscan"endure"negativeprocessingmargins(similartohigh-sulfurfueloil).

Marketperformancein2022

Demandforrefinedoilproductshasrisen,priceshaverisen,processingprofitshaverisen,andnaphthapricesarehigh

⬇

Thefundamentaldemandforchemicaldownstreamispoor,whilethepriceofnaphthaishigh,thecostofchemicalrawmaterialsishigh,andthechemicalprofitisnegative

⬇

Thechemicalchainnegativelyfedbacktonaphtha,andtheprofitofnaphthaprocessingfellwiththeprice

Theprofitofthechemicalchainisnotonlydeterminedbythecostofnaphtha,butalsobythesupplyanddemandsideofthechemicalitself.

Firstofall,thepriceofnaphthadidnotrisesharplyduetonegativefeedbackdownstream,andtheprocessingprofitofrefinedoilwasnegativelycorrelatedwiththeprocessingprofitofnaphthaandtheprofitofthechemicalindustry.

Secondly,theprofitofrefinedoilistoogood,therefineryisfulloffirepower,andtheproductionofnaphthaasa"by-product"isalsoveryhigh,soA.thesupplysideofnaphthaisrelativelysufficient,B.thedemandfornaphthademandsideofchemicalproductsispoor,thepriceofchemicalproductsislow,chemicalproductionprofitsaredeclining,chemicalenterprisesareoperatingdown,resultinginadecreaseindemandfornaphtha.

BothAandBcontributedtothedeclineinnaphthaprices,withtheabsolutepriceofnaphthafallingtoalowerlevelin2022,andtherelativepricespreadtoclothoilalsoataseasonallow.

"Crudeoil-refinedoil/naphtha-chemicals"Whoisthebossinthechain?

Withoutconsideringtheimpactofgeopoliticalconflicts/crudeoilsupplyshocks,thetotalvolume,price,profit,andfluctuationareaffectedbytherefinedoil.