坐以袋币!哪个股市更有潜力? Sit back with a bag of coins! Which stock market has more potential?

来源:港股解码

潮涨潮退,是地球的自然现象;同样,在资本市场,潮涨潮退也是常规操作,有起有伏,有流出的资产类别,自然会有接纳这些资金的去处。

持币趋向

“股神”巴菲特投资旗舰$伯克希尔-A(BRK.A.US)$上周五通过大宗交易,以大约137.1亿卢比(约合1.647亿美元)的价格,出清其在印度支付公司Paytm的所持有1560万股持股,加权平均成本价约为877.29卢比。

巴菲特最初投资软银支持的Paytm是在2018年9月,以220亿卢比(约合3亿美元)买入其2.6%的权益。随后在Paytm于2021年11月上市时,伯克希尔及时地减持了当时价值22亿卢比的股份。这次清仓之后,巴菲特于Paytm的投资或损失60亿卢比。

伯克希尔的清仓并非无迹可寻,据报道,这家印度支付公司或面临印度最严厉的监管,将受到最近监管机构干预零售贷款的影响,有关的措施主要面向非银行金融公司和银行的消费者贷款。

因此,资金流出一项资产是基于理性决定,同样,流入一项资产也是基于理性的考量。

事实上,最近几个季度伯克希尔持续减持或退出股份股权投资,将资金囤了起来。

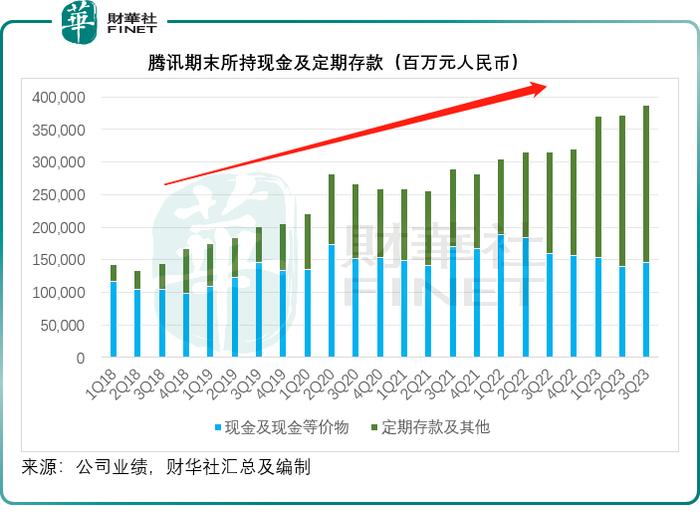

于2023年9月30日,伯克希尔所持的现金季现金等价物已高达1,170.41亿美元,相当于一个星巴克为3761.45亿元人民币,较上个季度降低52.13亿元人民币,所持有的现金及定期存款规模则达到3874.51亿元人民币,高于三个月前的3718.32亿元人民币,见下图。

财华社已在今年9月发布的文章阐述了大路资金的流向——货币基金,持币与流动性债券蔚然成风,这其实也意味着资金正在等待机会,而不是直接投入久期更长的投资产品,例如长期债券,或许可以推断,这部分资金是松动的,当物色到具有吸引力的投资标的时,这些资金很大可能快速集结。

那么,现在哪个市场最有可能带来收益?我们先来看看宏观环境。

全球利率环境

从其央行最新表态来看,欧盟和英国的加息周期很有可能快要终结,不过高利率在短期内仍将持续。

美联储的加息周期也可能在明年中下旬之前完结,但考虑到当前的通胀仍偏高,转向降息以刺激经济或尚需时间。

这意味着到明年上半年,欧美成熟经济体的高利率水平将会维持。随着高利率持续的时间越长,对于这些地区的企业影响越大,加息会带来投资的收缩、成本的增加,传递到企业端及实体经济通常有半年到一年以上的消化时间。

或许可以预期,加息对欧美企业经济活动的影响将在明年下半年加快体现,资本市场(例如股市)一般会提早反映,间隔或半年至一年(因实际经济活动与会计、财报存在时间差,股市一般会提前反映企业的经营表现),这或意味着欧美股市在明年上半年可能会出现回调压力。

在现今,美元依然是全球最重要的交易货币、结算货币以及使用货币,也因此美元资金走向哪里,哪里更容易掀起巨浪,最近的日股就是典型的例子。

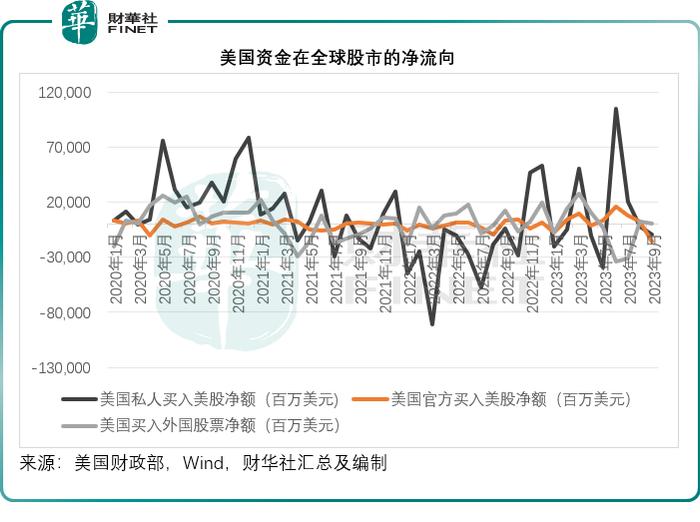

财华社从美国财政部的数据留意到,美国本土私人资金的走势与宏观经济走向一致:在2020年全面刺激经济,利率见底的2020年,美国私人买入美股的规模大幅攀升,而到2022年初美联储蓄势待发准备加息之前,当地私人资本开始从美股出逃,再到最近的6月,由于企业业绩理想以及加息预期转弱的憧憬,当地私人资金又再冲入美股,而到最近两个月,资金开始出逃。

值得留意的是,在6月份当地私人资本大买美股之际,美国于外国股票的现金流出也达到最高。不过到最近两个月资金开始从美股出走时,美国对外国股票的投资又再恢复正流入,见下图。

说到外国股票,相信大家首先会想到今年尤其出彩的日股。

还是日股吗?

今年以来,巴菲特屡屡增持日股大大提振了全球资金对日股市场的信心,国际游资大量涌入,让日股见到了春天。

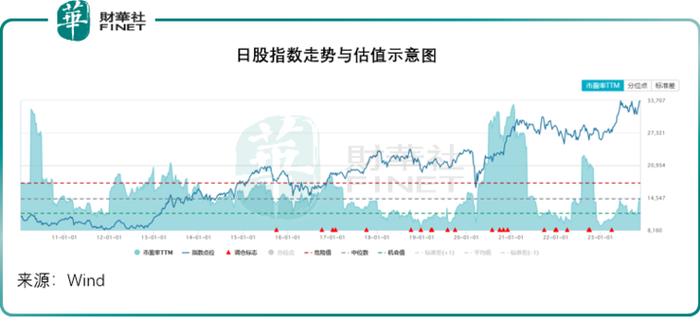

见下图,日经225指数的点位(蓝线)在今年大幅攀升,而市盈率估值(阴影部分)似乎尚适宜,也仅到达中位数水平而已,也许意味着仍有向上的余地。

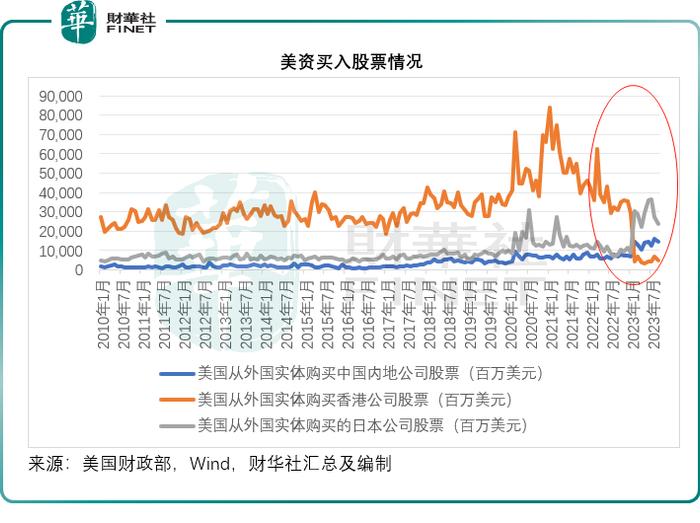

作为国际金融中心的港股市场一直是美国投资者热衷投资的目的地,在2020年-2021年全球牛市期间,进入港股市场的美国资金也十分显著,长期高于日股。但是今年以来,投资港股市场的美资显著收缩,而投资日股的却反向飙前,见下图。

美资买日股的趋势会一直持续吗?恐怕未必。

见下图,在四月份巴菲特透露出对日股的钟爱后,流入日股的美资大幅攀升,但其后出现放缓,到9月份更是大跌,10月份稍稍回升,不过显得颇为踌躇。

需要注意的是,日本经济GDP中,出口贸易占了大部分,因此币值对其意义重大。日元利率长期处于零及负利率,得益于欧美加息,日元相对于欧元和美元的币值持续受压,有利其出口企业。

但是欧美加息周期不可能永远持续,一旦欧美利率周期转向,将带起日元升值压力,从而令出口企业的盈利能力受到影响。最重要的是,长期处于零息的日元,可调控的空间也十分有限,也很被动,将更容易受到国际利率市场风向变化的影响。

未来资金走向何方?

那么资金会走向何方?可能是下降几率较低的市场,例如港股和A股,拥有世界最大经济体和消费群体之一,大中华区的经济活动不容忽视,经过连场下跌,两地市场的估值已处于偏低的水平,进一步下跌的空间或有限,失败几率相对较低。

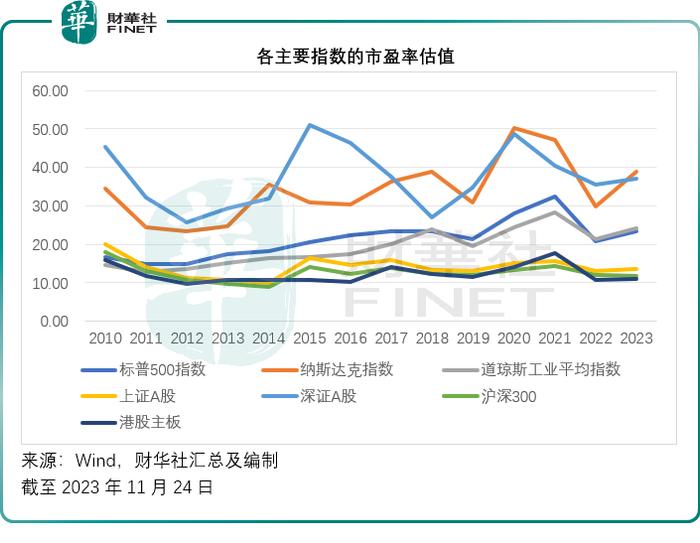

见下图,美股今年反弹带起了标普、纳斯达克指数与道指(DJI.US)的市盈率估值,但是A股与港股大致持平,港股的市盈率更跌至最低。

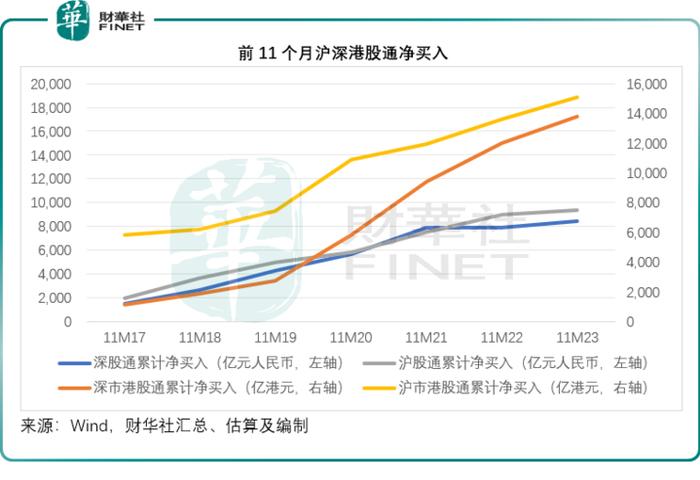

外资流走应是令两地市场受压的其中一个主要原因,见下图,北向资金(南水)通过沪深股通(到A股)的累计净流入几乎持平,而南向资金(A股账户通过港股通进入H股的资金)却持续攀升,这反映外资虽走,但内资仍在买。

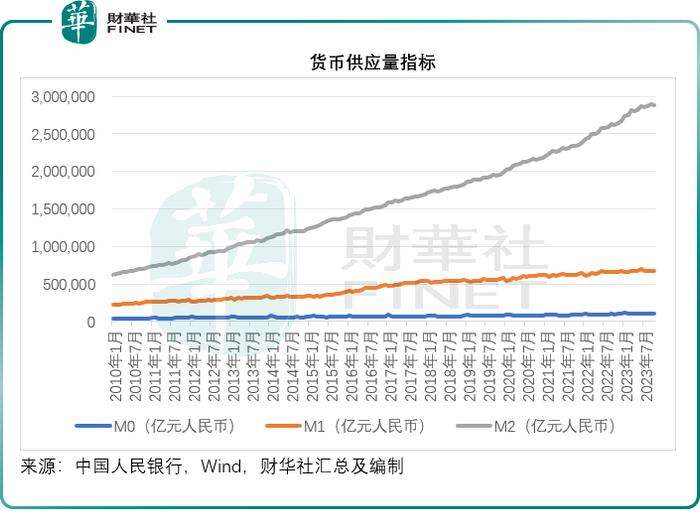

此外,央行的数据显示,相对于M0和M1的扩张速度,M2的扩张持续保持加速度,见下图,M2与M0和M1的差距持续拉大。

M0通常指的是银行体系外流通的现金;M1通常指的是M0与企业活期存款,或反映当前的社会购买力;M2通常指的是M1加个人及企业存款,反映的是消费或支出潜力。而从当前M2增速远超M0与M1可以看出,存款规模在持续扩大,也意味着消费和支出潜力巨大,只是大家不愿意用来消费或投资。

所以从资金的基本面来看,可用来投资的资金是存在的,只是大家更宁愿保持观望的态度,看看全球宏观经济环境的变化,以及经济复苏的速度。

从另一个角度来看,外资的大量流出也意味着AH股的风险进一步下降(资金带来的波动与震荡或显著降低),而我们已在上文分析,目前外国投资者以及有实力的企业都倾向于囤积现金以等待机会。从这个角度来看,一旦他们物色到市场出现机会,他们能灵活快速地将资金调配到相应的市场赚取较高的回报,而估值偏低的市场例如AH股或更具反弹潜力。所以短暂的撤离未必是坏事,或许为其回流累积更大的动能。

编辑/Corrine

Source:HongKongStockDecoded

TidesandebbsareanaturalphenomenononEarth;similarly,inthecapitalmarket,ebbsandflowsarealsoroutineoperations.Thereareupsanddowns,andthereareoutflowsofassetclasses,soofcoursetherewillbeplacestoacceptthesefunds.

Coinholdingtrends

“Stockgod”Buffettinvestsinflagship$BerkshireHathaway-A(BRK.A.US)$Itcleared15.6millionsharesheldbyIndianpaymentcompanyPaytmatapriceofabout13.71billionrupees(US$164.7million)throughabulktransactiononFriday.Theweightedaveragecostpricewasabout877.29rupees.

BuffettfirstinvestedinPaytmbackedbySoftBankinSeptember2018,buying2.6%ofitsequitywith22billionrupees(about300millionUSdollars).Then,whenPaytmwentpublicinNovember2021,Berkshirepromptlyreduceditssharesworth2.2billionrupeesatthetime.Afterthisclearance,Buffett'sinvestmentinPaytmmayhavelost6billionrupees.

Berkshire'sclearanceisnotwithoutatrace.Accordingtoreports,thisIndianpaymentcompanymayfacethestrictestregulationinIndiaandwillbeaffectedbytherecentregulatoryagencyinterventioninretailloans.Therelevantmeasuresaremainlyaimedatconsumerloansfromnon-bankfinancialcompaniesandbanks.

Thus,capitaloutflowsfromanassetarebasedonrationaldecisions;similarly,inflowsintoanassetarealsobasedonrationalconsiderations.

Infact,inrecentquarters,Berkshirehascontinuedtoreduceitsholdingsorwithdrawfromequityinvestment,hoardingcapital.

AsofSeptember30,2023,thecashequivalentofthecashseasonheldbyBerkshirehasreachedUS$117.041billion,whichisequivalenttothemarketvalueofaStarbucks().Sincethisyear,theamountofcashheldbyBerkshirehasincreasedbyUS$30.225billion,asshowninthechartbelow.

Similarly,duetothepoorperformanceofthesecondarymarketandtheundervaluationoftheexitfromtheprimarymarket,largetechnologycompaniesthatareintheharvestperiodandpreferventurecapitalandventurecapitalhavealsosloweddownthepaceofacquisitionsandinsteadhoardedcash.

Theonethatisjokinglycalledaninvestmentcompany$TENCENT(00700.HK)$Forexample,inthepast,itwasnecessarytoinvestinmanyventurecapitalandventurecapitalcompanieseveryyear,butfromthesecondhalfof2022tothisyear,thepaceofinvestmenthasclearlysloweddown,andexpenseshavebeenexpandedandcostsreducedthroughopensourceandsavings.

OnSeptember30,2023,thebookvalueofTencent'sunlistedinvestments(includingwealthmanagementproducts)was376.145billionyuan,adecreaseof5,213billionyuanfromthepreviousquarter.Theamountofcashandtimedepositheldreached387.451billionyuan,upfrom371,832billionyuanthreemonthsago,asshowninthechartbelow.

AnarticlepublishedbyCaihuaNewsAgencyinSeptemberofthisyearexplainsthegeneralflowofcapital—monetaryfunds,currencyholdings,andliquidbondsarealltherage.Thisactuallyalsomeansthatcapitaliswaitingforanopportunityratherthandirectlyinvestingininvestmentproductswithalongerperiodoftime,suchaslong-termbonds.Itmaybededucedthatthisportionofcapitalisloose.Whenattractiveinvestmenttargetsarefound,thesefundsarelikelytoaccumulatequickly.

So,whichmarketsaremostlikelytogeneraterevenuerightnow?Let'stakealookatthemacroenvironmentfirst.

Globalinterestrateenvironment

Judgingfromitscentralbank'slateststatement,itislikelythattheinterestratehikecycleintheEUandtheUKwillsooncometoanend,buthighinterestrateswillcontinueintheshortterm.

TheFed'sinterestratehikecyclemayalsoendbeforemid-latenextyear,butconsideringthatcurrentinflationisstillhigh,itmaytaketimetoswitchtointerestratecutstostimulatetheeconomy.

Thismeansthatbythefirsthalfofnextyear,thehighinterestratesofmatureEuropeanandAmericaneconomieswillremainhigh.Ashighinterestratescontinueforlonger,theimpactonenterprisesintheseregionsbecomesgreater.Interestratehikeswillleadtoacontractionininvestmentandanincreaseincosts,whicharetransmittedtotheenterprisesideandtherealeconomy,whichusuallytakeshalfayeartoayearormoretodigest.

ItmaybeanticipatedthattheimpactofinterestratehikesontheeconomicactivitiesofEuropeanandAmericancompanieswillbereflectedfasterinthesecondhalfofnextyear,andcapitalmarkets(suchasthestockmarket)willgenerallyreflectearly,atintervalsofhalfayeartooneyear(duetothetimedifferencebetweenactualeconomicactivityandaccountingandfinancialreports,thestockmarketwillgenerallyreflectthebusinessperformanceofenterprisesinadvance).ThismaymeanthattheEuropeanandAmericanstockmarketsmayexperiencepullbackpressureinthefirsthalfofnextyear.

Today,theUSdollarisstillthemostimportanttradingcurrency,settlementcurrency,andcurrencyofuseintheworld.Therefore,whereisthedollar'scapitalgoingandwhereitismorelikelytocausehugewaves?TherecentJapanesestockmarketisatypicalexample.

CaihuaNewsAgencynoticedfromdatafromtheUSTreasuryDepartmentthatthetrendofprivatecapitalintheUSisinlinewiththemacroeconomictrend:in2020,whentheeconomywasfullystimulatedin2020andinterestratesbottomedout,thescaleofUSprivatepurchasesofUSstocksrosesharply.Untilthebeginningof2022,beforetheFederalReservewaspoisedtoraiseinterestrates,localprivatecapitalbegantofleefromUSstocksuntilrecentlyinJune,duetoidealcorporateperformanceandweakeningexpectationsofinterestratehikes,localprivatecapitalhasonceagainrushedintoUSstocks,andinthelasttwomonths,capitalhasbeguntoflee.

ItisworthnotingthatwhenlocalprivatecapitalboughtUSstocksinJune,UScashoutflowsfromforeignstocksalsoreachedthehighestlevel.However,bythetimecapitalbegantowithdrawfromUSstocksinthelasttwomonths,USinvestmentinforeignstockshadresumedpositiveinflows,asshowninthechartbelow.

Whenitcomestoforeignstocks,IbelieveeveryonewillfirstthinkofJapanesestocks,whichhavebeenparticularlyprominentthisyear.

IsitstillaJapanesestock?

Sincethisyear,Buffett'srepeatedincreaseinJapanesestockholdingshasgreatlyboostedglobalcapital'sconfidenceintheJapanesestockmarket.AlargeinfluxofinternationalinvestorshasbroughtspringtoJapanesestocks.

Asyoucanseeinthechartbelow,theNikkei225index(blueline)hasrisensharplythisyear,whiletheprice-earningsratiovaluation(shadedpart)seemstobeappropriateandhasonlyreachedthemedianlevel,whichmaymeanthereisstillroomforimprovement.

Asaninternationalfinancialcenter,theHongKongstockmarkethasalwaysbeenakeeninvestmentdestinationforUSinvestors.Duringtheglobalbullmarketfrom2020to2021,theUScapitalenteringtheHongKongstockmarketwasalsoremarkable,andwashigherthanJapanesestocksforalongtime.However,sincethisyear,USinvestmentintheHongKongstockmarkethasshrunkmarkedly,whileinvestmentinJapanesestockshasinsteadsoared.Seethechartbelow.

WillthetrendofUSinvestorsbuyingJapanesestockscontinue?I'mafraidit'snotnecessary.

Asyoucanseeinthechartbelow,afterBuffettrevealedhisloveforJapanesestocksinApril,theinflowofUScapitalintoJapanesestocksrosesharply,butthentherewasaslowdown,thentherewasasharpdeclineuntilSeptember.TherewasaslightrecoveryinOctober,butitseemedquitehesitant.

ItshouldbenotedthatexporttradeaccountsforthemajorityoftheJapaneseeconomy'sGDP,sothevalueofthecurrencyissignificanttoit.InterestratesontheJapaneseyenhavebeenatzeroandnegativeinterestratesforalongtime.ThankstointerestratehikesinEuropeandtheUS,thevalueoftheyencontinuestobepressuredagainsttheeuroandtheUSdollar,whichisbeneficialtoitsexportingcompanies.

However,theinterestratehikecycleinEuropeandtheUScannotlastforever.OncetheEU-USratecyclechanges,itwillputpressureontheyentoappreciate,therebyaffectingtheprofitabilityofexportingcompanies.Mostimportantly,theJapaneseyen,whichhasbeenatzerointerestforalongtime,hasverylimitedroomforcontrolandisalsoverypassive,soitwillbemoresusceptibletochangesinthedirectionoftheinternationalinterestratemarket.

Wherewillcapitalgointhefuture?

Sowherewillthecapitalgo?Itmaybethatmarketswithalowchanceofdecline,suchasHongKongstocksandAshares,haveoneofthelargesteconomiesandconsumergroupsintheworld.EconomicactivityinGreaterChinacannotbeignored.Afteraseriesofdeclines,thevaluationofthetwomarketsisalreadyatalowlevel.Theremaybelimitedroomforfurtherdecline,andthechanceoffailureisrelativelylow.

Asshowninthechartbelow,thereboundinUSstocksthisyearledtoprice-earningsratiovaluationsforS&P,theNasdaqIndex,andtheDow(DJI.US),butA-shareswereroughlythesameasHongKongstocks,andtheprice-earningsratioofHongKongstocksfelltoaminimum.

Theflowofforeigncapitalshouldbeoneofthemainreasonsforthepressureonthemarketsofthetwoplaces.Asshowninthechartbelow,thecumulativenetinflowofnorthboundcapital(southwater)throughtheShanghaiandShenzhenStockExchange(toAshares)hasremainedalmostflat,whilesouthboundcapital(capitalfromA-shareaccountsenteringHsharesthroughHongKongStockConnect)continuestorise.Thisreflectsthatalthoughforeigncapitalhasleft,domesticcapitalisstillbuying.

Furthermore,centralbankdatashowsthatcomparedtotheexpansionrateofM0andM1,theexpansionofM2continuestoaccelerate.Asshowninthechartbelow,thegapbetweenM2,M0,andM1continuestowiden.

M0usuallyreferstocashcirculatingoutsideofthebankingsystem;M1usuallyreferstoM0andcorporatedemanddeposits,orreflectscurrentsocialpurchasingpower;M2usuallyreferstoM1pluspersonalandcorporatedeposits,reflectingconsumptionorspendingpotential.However,ascanbeseenfromthecurrentM2growthrate,whichfarexceedsM0andM1,thesizeofdepositscontinuestoexpand,whichalsomeansthatthereishugepotentialforconsumptionandexpenditure,butpeopleareunwillingtospendorinvest.

Therefore,judgingfromthefundamentalsofcapital,thereiscapitalthatcanbeusedforinvestment,butpeopleprefertomaintainawait-and-seeattitudeandseethechangesintheglobalmacroeconomicenvironmentandthespeedofeconomicrecovery.

Fromanotherperspective,thelargeoutflowofforeigncapitalalsomeansafurtherreductionintheriskofAHshares(fluctuationsandshockscausedbycapitalmaybesignificantlyreduced),yetaswehaveanalyzedabove,currentlyforeigninvestorsandpowerfulcompaniestendtohoardcashtowaitforopportunities.Seenfromthisperspective,oncetheyidentifyopportunitiesinthemarket,theycanflexiblyandquicklyallocatecapitaltocorrespondingmarketstoearnhigherreturns,whileundervaluedmarkets,suchasAHshares,mayhavemorepotentialtorebound.Therefore,abriefwithdrawalisnotnecessarilyabadthing;itmayaccumulatemoremomentumforitsreturn.

Editor/Corrine